Despite today's United Nations deadline for Iran to give up its nuclear bomb program, Iran has done no such thing. The next diplomatic move is supposed to be for the U.N. to impose sanctions on Iran. That won't work, either...

Claudia Rosett writing in today's Wall Street Journal.

Thursday, August 31, 2006

Render Unto Caesar...

"You know, the Lord has told us that his share is a tenth of what we earn, and He has told us that if we prosper 10 times as much, we will give 10 times as much. But when we start computing Caesar's share under our present tax policy, you can prosper 10 times as much and find you're paying 50 times as much tax. So, I think what's fair for the Lord ought to be more reasonably fair for Caesar."

"You know, the Lord has told us that his share is a tenth of what we earn, and He has told us that if we prosper 10 times as much, we will give 10 times as much. But when we start computing Caesar's share under our present tax policy, you can prosper 10 times as much and find you're paying 50 times as much tax. So, I think what's fair for the Lord ought to be more reasonably fair for Caesar."Ronald Reagan, Remarks to Religious Leaders at a White House Meeting on Tax Reform, October 29, 1985

Wednesday, August 30, 2006

Who's the Pig in the Closet?

God help the poor, piggy senator behind the “secret hold” on S.2590.

God help the poor, piggy senator behind the “secret hold” on S.2590. Whoever this Porky Pig lawmaker is, you can take it to the bank that he/she isn’t getting much sleep these days. And, if this senator is sleeping (with the help of handfuls of Ambien no doubt), they’re likely dreaming of a way out of the wretched mess they created for themselves.

Here’s a question: Why in the world would any above-board lawmaker attempt to shelve this pork transparency legislation?

What’s so scary about a little old website that would allow voters to see where their own hard-earned tax dollars are going? What the heck are they so afraid of?

It’s great to see the power of the blogosphere on this one. Both sides have come together calling for an end to the earmark madness. As Martha is apt to saying, “This is a good thing.”

From Glenn Reynolds of both Porkbusters and Instapundit (who deserves credit for spearheading this whole thing) to the fiscally responsible Club for Growth’s Andy Roth, all the way across the political spectrum to the lefties over at Daily Kos, bloggers have spoken in one unified voice and have issued their edict: NO MORE PORK.

It isn’t everyday that you see virtually unanimous agreement from the left and right. But, when you do, whenever both sides of our polarized, political divide rally together against an “as-yet” unidentified lawmaker; whenever red and blue voters join hands and turn purple in a common cause, well, you’ve just got to know that they’re on to something.

After all, this is our money lawmakers are playing around with, not theirs. Much of Washington seems to have forgotten this fact, which is why cancerous pork-barrel earmarking skyrocketed to around 13,000 earmarks this year, costing taxpayers $64 billion dollars. It is also the reason why some shady senator sees fit to put a secret hold on valuable legislation that would help clean up this earmark nightmare.

When you consider the resounding success of President Bush’s tax cuts, and all the money that’s been pouring into the Treasury as a result, you’ve got to shake your head in disbelief and think: Had their been some fiscal accountability in Congress this year, some tightening of the budget belt, we’d be in a far better budgetary position.

God help this poor lawmaker. Porky may get roasted.

Tuesday, August 29, 2006

A New Life Has Been Born

(The following excerpt is from an interview I gave to The American Spectator back in March of 2001. )

TAS: How did you become a Catholic?

Kudlow: I had a problem with alcohol and cocaine. In the winter of 1993 I had spent a month in a treatment center here in New York. It taught the twelve-step program. God plays a role, but it's more the spiritual God of your choice. But at least there's something. I was not raised religious but I was searching for help. I remember that in this little prep school that I went to, the Dwight Englewood School in New Jersey, we had to say the Lord's Prayer in homeroom. Every morning at your desk you put your head down and say the Lord's Prayer. I was there grade seven through twelve, so it's something you remember. When I was going into this dark abyss with alcohol and cocaine, after some terrible binge, I can remember lying in bed desperate and I started saying the Lord's Prayer. What made me do that? Just--I was desperate, I was trying to ask for help. You know, who was going to get me out of this? I started searching for God.

TAS: So then what happened?

Kudlow: It was Jeff Bell, an old supply-side ally, who actually got me started with the Church. That same winter I was in the treatment center I bumped into Jeff on the street. I was still at Bear Stearns so it was 45th and Park. Now I knew that somewhere along the line he had converted to Catholicism. We started talking, and I told him--I don't know why because not many people knew about my problem yet--I told him that I was taking some steps that had recreated my faith in God. I didn't really tell him much. Then one day Father C. John McCloskey appeared at Bear Stearns. My secretary said, "This priest is here to see you." No appointment, but a lot of the partners donated to various charities. So I was ready to pull out my checkbook and write a thousand dollars to whatever. But this guy didn't want any money. He was a friend of Jeff Bell's and he wanted to talk to me. And he was a very engaging man.

TAS: Wasn't he a gold trader before becoming a priest?

Kudlow: Right. At Merrill. But that day he said he had been watching me on TV on the financial shows. "You've changed," he said. He was right. I was trying to be more restrained, calmer, things they taught me in treatment. So then he asked me, "Do you believe in the hereafter?" My answer was yes, because that's what you're taught in the Jewish faith, though I had not been raised very religious and I hadn't been in a temple since I was fifteen. Then, "Do you believe in Jesus Christ?" And I said I didn't know. But I didn't say no. He gave me a book or two to read and then said: "Why don't you try going to Mass?" I told him I had never been. "Do you have any opposition to it?" I said no. But, I would feel a little odd just walking into a Catholic Church. He said, well, lots of people do it. Then he introduced me to a friend who went to St. Thomas More on 89th and Madison, near where I lived. And I loved it. I loved the Mass.

TAS: Why?

Kudlow: If done right it has a certain mystical quality, and it appealed to me. It was different from anything I had been exposed to. I went to a retreat and I didn't like it because I didn't understand it, mostly. But it wasn't church. The church part is what I liked, the actual Mass. I liked the robes, the smoke. I loved it. All these rituals and rules. I began to realize that for the past eight or ten years I had been living without them. I was the rule. I was so self-centered. I'd just do whatever I felt like. I was in my master-of-the-universe period. You can't live that way. Nobody can. I knew it wasn't good and the drugs and the booze were part of it.

TAS: How are drugs part of that?

Kudlow: You become so self-centered and self-willed that you decide you can do anything, without regard for others. I wasn't showing up for events, for friends, for my wife. I'd go missing in action for days. I've made amends to people directly, but still, I'm ashamed about that period. But the church offered me a regulated regime for life, as did my twelve-step program. The two are similar because Bill Wilson, the founder of A.A., had been part of the Oxford Group, and a Catholic priest from St. Louis was his mentor. Anyhow, I knew this was something I should be doing, just from a selfish standpoint. I needed regulation. I needed to be taught rules of the road. It took me awhile to get my arms around it. But as I hit bottom, Ilost jobs, lost all income, lost friends, and very nearly lost my wife. I was willing to surrender and take it on faith that I had to change my life.

TAS: But you became a Catholic. So you had to stand up and say I believe some very specific things.

Kudlow: I was going to Mass on Sundays. And we recite the Nicene Creed, the church's statement of beliefs. There came this one day when I stopped just mouthing it and read it in an intellectual, cognitive way, and realized there's a whole story here. If you read the eucharistic part of the Mass, there's a whole story there and it's a fabulous story.

TAS: What is that?

Kudlow: It's--we are partaking of the body and blood of Christ. That's what I understand the Eucharist to be. We are pledging our faith in him and what he taught and all of a sudden it clicked, that Jesus Christ does not want me to touch alcohol or drugs because I wreck my body and I wreck his body and I wreck my life. Jesus died for me, too. And that is my redemption. I'm not a Catholic intellectual. I will never be one. I'm not interested in that. I'm interested in how I live my life each day. How I conduct my relationships with people. My view of Lord Jesus is very basic in that sense, though I have read some books that are interesting to me, including Fr. Richard John Neuhaus's recent book, Death on a Friday Afternoon.

TAS: He's a priest in New York, edits First Things.

Kudlow: The basic thought in the book is that even we optimistic Americans mustn't ever forget that Jesus spent that time on the cross, painfully. His crown of thorns was sticking into his skull, he was nailed to the cross, and it was horrible. The book had an impact on me, because in my own mundane, low-level way, I was on the cross. I don't know if I've had salvation, but I have had a change. Sobriety is one of the keys to my faith. And that's good because for me to destroy my life is a rejection of Jesus. In my worst moments--and I still get a few--the reason I don't go out and do something crazy is because I don't want to break my bond with God.

TAS: Sometimes people forget how tough addictions can be.

Kudlow: You see, what this journey is really about is changing along Christian principles. I still do stupid things, but I also go to confession. One of the things I like about Mass is that you go on your knees for part of the time. It is a wonderful thing to learn some humility. I was at Mass the other day and I was having some trouble, and I prayed. I didn't ask for an outcome, just help. Please show me some clarity, some calmness, give me a sign, and it worked. Took about a day, but it worked. I don't pray for stuff that I want. I ask help for stuff that I believe I need.

TAS: The Pope would say that the original reason God gave us liberty was to complete his creation. And that does take us back to economics and politics. It's no accident that your favorite dead economist, Joseph Schumpeter, focused on creativity.

Kudlow: That's why "supply side" doesn't really capture it. The reason we have the best economic and stock market record in the world is we are the freest country in the world. We call it supply-side economics, but what we're really fighting for is more freedom. Not unlimited freedom, and that's where faith comes in. Since God granted us our liberty, for which we are eternally grateful, we must reflect that by abiding by his rules. It's the rule part that I've come to acknowledge and frankly love. This is part of that mystery of faith, but I believe Jesus is with me. He enters my body and mind as long as I'm open to him and prevents me from doing something really stupid or from misbehaving. I believe that. Last Saturday, when I was at sixes and sevens in my own head, which is a risky real-estate section to be in, I believe Jesus came to me. I believe he somehow entered into my head for the next 48 hours and helped me get through this little patch. People brought Jesus to me: Fr. McCloskey, Jeff Bell, my mentor Sim Johnston. And He helps keep me sober every day and helps me to discharge my responsibilities.

TAS: Do you think you will write more about this?

Kudlow: I believe it is possible that the Holy Spirit can bring a certain ability to explain my faith. But not in an intellectual way. I don't possess those tools. Just in a personal way: Here's why I go to Mass, here's what it's done for me. Some people want me to carry the sword of Catholicism the way I carry the sword of free-market economics. It's not my goal and if it does happen, it will not be by my design. It's very personal. Jesus is my Father. He's also my Supreme Court because the court has rules and if you break them you get into trouble. In my twelve-step program there's all these young kids who went to Catholic school and rebelled. And they always get up and say how they rebelled against the Church and its rules. I just nod my head and kid them. I say, well, you don't understand how wonderful those rules are. Take it from me. I came to it late in life, but that's exactly the way it was supposed to be. I wrecked my life. It was literally destroyed. My old life was taken and a new life has been born. I understand now that all that had to happen. There's a script here. It's just that I didn't write it.

TAS: How did you become a Catholic?

Kudlow: I had a problem with alcohol and cocaine. In the winter of 1993 I had spent a month in a treatment center here in New York. It taught the twelve-step program. God plays a role, but it's more the spiritual God of your choice. But at least there's something. I was not raised religious but I was searching for help. I remember that in this little prep school that I went to, the Dwight Englewood School in New Jersey, we had to say the Lord's Prayer in homeroom. Every morning at your desk you put your head down and say the Lord's Prayer. I was there grade seven through twelve, so it's something you remember. When I was going into this dark abyss with alcohol and cocaine, after some terrible binge, I can remember lying in bed desperate and I started saying the Lord's Prayer. What made me do that? Just--I was desperate, I was trying to ask for help. You know, who was going to get me out of this? I started searching for God.

TAS: So then what happened?

Kudlow: It was Jeff Bell, an old supply-side ally, who actually got me started with the Church. That same winter I was in the treatment center I bumped into Jeff on the street. I was still at Bear Stearns so it was 45th and Park. Now I knew that somewhere along the line he had converted to Catholicism. We started talking, and I told him--I don't know why because not many people knew about my problem yet--I told him that I was taking some steps that had recreated my faith in God. I didn't really tell him much. Then one day Father C. John McCloskey appeared at Bear Stearns. My secretary said, "This priest is here to see you." No appointment, but a lot of the partners donated to various charities. So I was ready to pull out my checkbook and write a thousand dollars to whatever. But this guy didn't want any money. He was a friend of Jeff Bell's and he wanted to talk to me. And he was a very engaging man.

TAS: Wasn't he a gold trader before becoming a priest?

Kudlow: Right. At Merrill. But that day he said he had been watching me on TV on the financial shows. "You've changed," he said. He was right. I was trying to be more restrained, calmer, things they taught me in treatment. So then he asked me, "Do you believe in the hereafter?" My answer was yes, because that's what you're taught in the Jewish faith, though I had not been raised very religious and I hadn't been in a temple since I was fifteen. Then, "Do you believe in Jesus Christ?" And I said I didn't know. But I didn't say no. He gave me a book or two to read and then said: "Why don't you try going to Mass?" I told him I had never been. "Do you have any opposition to it?" I said no. But, I would feel a little odd just walking into a Catholic Church. He said, well, lots of people do it. Then he introduced me to a friend who went to St. Thomas More on 89th and Madison, near where I lived. And I loved it. I loved the Mass.

TAS: Why?

Kudlow: If done right it has a certain mystical quality, and it appealed to me. It was different from anything I had been exposed to. I went to a retreat and I didn't like it because I didn't understand it, mostly. But it wasn't church. The church part is what I liked, the actual Mass. I liked the robes, the smoke. I loved it. All these rituals and rules. I began to realize that for the past eight or ten years I had been living without them. I was the rule. I was so self-centered. I'd just do whatever I felt like. I was in my master-of-the-universe period. You can't live that way. Nobody can. I knew it wasn't good and the drugs and the booze were part of it.

TAS: How are drugs part of that?

Kudlow: You become so self-centered and self-willed that you decide you can do anything, without regard for others. I wasn't showing up for events, for friends, for my wife. I'd go missing in action for days. I've made amends to people directly, but still, I'm ashamed about that period. But the church offered me a regulated regime for life, as did my twelve-step program. The two are similar because Bill Wilson, the founder of A.A., had been part of the Oxford Group, and a Catholic priest from St. Louis was his mentor. Anyhow, I knew this was something I should be doing, just from a selfish standpoint. I needed regulation. I needed to be taught rules of the road. It took me awhile to get my arms around it. But as I hit bottom, Ilost jobs, lost all income, lost friends, and very nearly lost my wife. I was willing to surrender and take it on faith that I had to change my life.

TAS: But you became a Catholic. So you had to stand up and say I believe some very specific things.

Kudlow: I was going to Mass on Sundays. And we recite the Nicene Creed, the church's statement of beliefs. There came this one day when I stopped just mouthing it and read it in an intellectual, cognitive way, and realized there's a whole story here. If you read the eucharistic part of the Mass, there's a whole story there and it's a fabulous story.

TAS: What is that?

Kudlow: It's--we are partaking of the body and blood of Christ. That's what I understand the Eucharist to be. We are pledging our faith in him and what he taught and all of a sudden it clicked, that Jesus Christ does not want me to touch alcohol or drugs because I wreck my body and I wreck his body and I wreck my life. Jesus died for me, too. And that is my redemption. I'm not a Catholic intellectual. I will never be one. I'm not interested in that. I'm interested in how I live my life each day. How I conduct my relationships with people. My view of Lord Jesus is very basic in that sense, though I have read some books that are interesting to me, including Fr. Richard John Neuhaus's recent book, Death on a Friday Afternoon.

TAS: He's a priest in New York, edits First Things.

Kudlow: The basic thought in the book is that even we optimistic Americans mustn't ever forget that Jesus spent that time on the cross, painfully. His crown of thorns was sticking into his skull, he was nailed to the cross, and it was horrible. The book had an impact on me, because in my own mundane, low-level way, I was on the cross. I don't know if I've had salvation, but I have had a change. Sobriety is one of the keys to my faith. And that's good because for me to destroy my life is a rejection of Jesus. In my worst moments--and I still get a few--the reason I don't go out and do something crazy is because I don't want to break my bond with God.

TAS: Sometimes people forget how tough addictions can be.

Kudlow: You see, what this journey is really about is changing along Christian principles. I still do stupid things, but I also go to confession. One of the things I like about Mass is that you go on your knees for part of the time. It is a wonderful thing to learn some humility. I was at Mass the other day and I was having some trouble, and I prayed. I didn't ask for an outcome, just help. Please show me some clarity, some calmness, give me a sign, and it worked. Took about a day, but it worked. I don't pray for stuff that I want. I ask help for stuff that I believe I need.

TAS: The Pope would say that the original reason God gave us liberty was to complete his creation. And that does take us back to economics and politics. It's no accident that your favorite dead economist, Joseph Schumpeter, focused on creativity.

Kudlow: That's why "supply side" doesn't really capture it. The reason we have the best economic and stock market record in the world is we are the freest country in the world. We call it supply-side economics, but what we're really fighting for is more freedom. Not unlimited freedom, and that's where faith comes in. Since God granted us our liberty, for which we are eternally grateful, we must reflect that by abiding by his rules. It's the rule part that I've come to acknowledge and frankly love. This is part of that mystery of faith, but I believe Jesus is with me. He enters my body and mind as long as I'm open to him and prevents me from doing something really stupid or from misbehaving. I believe that. Last Saturday, when I was at sixes and sevens in my own head, which is a risky real-estate section to be in, I believe Jesus came to me. I believe he somehow entered into my head for the next 48 hours and helped me get through this little patch. People brought Jesus to me: Fr. McCloskey, Jeff Bell, my mentor Sim Johnston. And He helps keep me sober every day and helps me to discharge my responsibilities.

TAS: Do you think you will write more about this?

Kudlow: I believe it is possible that the Holy Spirit can bring a certain ability to explain my faith. But not in an intellectual way. I don't possess those tools. Just in a personal way: Here's why I go to Mass, here's what it's done for me. Some people want me to carry the sword of Catholicism the way I carry the sword of free-market economics. It's not my goal and if it does happen, it will not be by my design. It's very personal. Jesus is my Father. He's also my Supreme Court because the court has rules and if you break them you get into trouble. In my twelve-step program there's all these young kids who went to Catholic school and rebelled. And they always get up and say how they rebelled against the Church and its rules. I just nod my head and kid them. I say, well, you don't understand how wonderful those rules are. Take it from me. I came to it late in life, but that's exactly the way it was supposed to be. I wrecked my life. It was literally destroyed. My old life was taken and a new life has been born. I understand now that all that had to happen. There's a script here. It's just that I didn't write it.

Where Was the Economic Vision?

The Wall Street Journal editorial, “The Tragedy of New Orleans,” quite rightly points out that President Bush and the Republican Congress have spent the utterly mind-blowing sum of $122.5 billion on Hurricane Katrina money largely designated for New Orleans.

One can only imagine the almost incomprehensive number of better purposes to spend this astonishing sum of money. And, still, leading Democratic politicians want to spend even more taxpayer dough as many New Orleans neighborhoods remain underwater (to coin a metaphorical phrase).

A much better approach would have been to employ the capitalist laws of the market economy and simply make New Orleans a tax-free zone. Though some tax abatements have been employed in enabling congressional legislation, neither the White House, nor Congress, ever went full bore on the supply-side to attract private capital investment and business to New Orleans.

Think of New Orleans as an emerging economy in the Third World, desperately seeking private investment flows, and perhaps the picture becomes clearer. Capital to finance human ingenuity, entrepreneurship, and the love of New Orleans that many have, would be a much more efficient, timely and simpler solution than the gargantuan, bureaucratic spending plan which was doomed to failure from the very start.

Let’s say for example, a zero capital gains tax. Or, perhaps, any new businesses started up in New Orleans would be tax-free for 5-10 years. This would include cash expensing for the building or rebuilding of any plant, home, office building or mall. Eliminating the tax costs of rebuilding New Orleans, coupled with high incentive rewards, after tax, would do the trick a lot quicker than this horrible central planning experiment.

Frankly, this is a case where neither the Bush Administration, nor the GOP leadership in Congress, gave New Orleans (or the United States for that matter), any economic vision at all. It is a shame.

One can only imagine the almost incomprehensive number of better purposes to spend this astonishing sum of money. And, still, leading Democratic politicians want to spend even more taxpayer dough as many New Orleans neighborhoods remain underwater (to coin a metaphorical phrase).

A much better approach would have been to employ the capitalist laws of the market economy and simply make New Orleans a tax-free zone. Though some tax abatements have been employed in enabling congressional legislation, neither the White House, nor Congress, ever went full bore on the supply-side to attract private capital investment and business to New Orleans.

Think of New Orleans as an emerging economy in the Third World, desperately seeking private investment flows, and perhaps the picture becomes clearer. Capital to finance human ingenuity, entrepreneurship, and the love of New Orleans that many have, would be a much more efficient, timely and simpler solution than the gargantuan, bureaucratic spending plan which was doomed to failure from the very start.

Let’s say for example, a zero capital gains tax. Or, perhaps, any new businesses started up in New Orleans would be tax-free for 5-10 years. This would include cash expensing for the building or rebuilding of any plant, home, office building or mall. Eliminating the tax costs of rebuilding New Orleans, coupled with high incentive rewards, after tax, would do the trick a lot quicker than this horrible central planning experiment.

Frankly, this is a case where neither the Bush Administration, nor the GOP leadership in Congress, gave New Orleans (or the United States for that matter), any economic vision at all. It is a shame.

On Mike Pence

The New York Times front page profile on my friend, Rep. Mike Pence, “Star of the Right Loses His Base at the Border,” is really all about the anti-immigration, far-right group led by Tom Tancredo of Colorado to oppose any broad-based immigration reform whatsoever—and to label any proposals for temporary workers, or even Pence’s 17 year citizenship path, as “amnesty.”

This word “amnesty” is being used to attack absolutely any conceivable immigration compromise. I could go on forever on this subject. I have written several columns on it. But at the end of the day, the Tancredo crowd, which includes Pat Buchanan, just wants border security to keep out immigrants.

They also want to deport all illegal or undocumented immigrants. “Border security” and “deportation” are their watchwords. They manage to completely ignore the economics of the problem, whereby Mexicans seeking higher paying jobs in the U.S. rather than the faltering Mexican economy can produce are coming here to work. After all, living conditions in the U.S. are a lot better for all but the richest people than they are in Mexico.

If we ever deported the 10-15 million undocumented workers, then the U.S. economy would be severely damaged. New studies show the Mexicans actually help the U.S. economy and wages actually rise overall, (though there are small losses in border town wages). Even unskilled American workers benefit from lower priced goods and services generated by these new Mexican worker-immigrants.

Pat Buchanan attacks me as “worshipping at the church of GDP.” But in a CNBC Kudlow and Company interview, I reminded him that I also worship at the church of Catholic Mass, as do the vast majority of the Mexican immigrants. These faith-based folks would create a new blue-collar middle class that is sorely needed in this country if we let them.

They would also finance Social Security over the next fifty years. Though it should be noted that academic research shows that 2/3rds of them pay Social Security with phony ID cards and will never receive the benefit as matters now stand. And, of course, they pay the sales tax on whatever purchases they make in stores.

The problem will never be solved unless we legally permit roughly 400,000 per year to fill the demand for U.S. jobs that are currently available. This resembles the Bracero Program and it must be part of any solution. It’s just plain common sense that at any given productivity rate, a larger labor force generates more GDP growth to the benefit of the U.S. economy. During the high tide of immigration, over the past twenty years, the U.S. has enjoyed unrivaled prosperity at low unemployment. So, again, I ask, if immigration is so bad, then why are things so good?

Yes, there should be tough border security. Yes, there should be foolproof ID cards, with biometrics, for Social Security and employment purposes. Former Sen. Alan Simpson of Wyoming, the co-author of the 1986 Simpson-Mazzoli immigration reform bill, has said the failure of that bill was a function of the lack of an ID card system.

But the intransigence of the Tancredo-Buchanan crowd is a remarkable political event which is all out of kilter with poll after poll that shows a substantial majority of respondents favor broad based immigration reform.

If these guys win, the Republican Party loses, and the nation loses. Unlike the big countries of Western Europe and Japan, the U.S. benefits from immigration that keeps our population rising. (In fact, harking back to the Catholic Mass, roughly 45 million unborn children have been killed since the abortion wave was launched by Roe v. Wade in the early 1970’s. We have an opportunity to replace this extraordinary loss of human life with hard headed but compassionate and economically sound immigration reform).

Incidentally, I wrote the article for Human Events when that newspaper awarded Congressman Pence its “2005 Man of the Year” award. I know Mike. The man is a wonderful, Reagan-thinking conservative. His life is governed by religious values, a belief in a strong national defense, and a pro-growth approach to low taxes and less government spending.

This Tancredo-Buchanan backstabbing does this rising GOP star a great disservice. If allowed to go unanswered, it would represent another devastating blow to the Republican Party.

While the Pence-Hutchinson immigration reform idea is not perfect, it does represent a useful discussion point for future action. As diplomatically and kindly as possible, with all the greatest respect for differing points of view, let me just say that the Tancredo-Buchanan attack on Mike Pence is nuttier than a fruitcake.

This word “amnesty” is being used to attack absolutely any conceivable immigration compromise. I could go on forever on this subject. I have written several columns on it. But at the end of the day, the Tancredo crowd, which includes Pat Buchanan, just wants border security to keep out immigrants.

They also want to deport all illegal or undocumented immigrants. “Border security” and “deportation” are their watchwords. They manage to completely ignore the economics of the problem, whereby Mexicans seeking higher paying jobs in the U.S. rather than the faltering Mexican economy can produce are coming here to work. After all, living conditions in the U.S. are a lot better for all but the richest people than they are in Mexico.

If we ever deported the 10-15 million undocumented workers, then the U.S. economy would be severely damaged. New studies show the Mexicans actually help the U.S. economy and wages actually rise overall, (though there are small losses in border town wages). Even unskilled American workers benefit from lower priced goods and services generated by these new Mexican worker-immigrants.

Pat Buchanan attacks me as “worshipping at the church of GDP.” But in a CNBC Kudlow and Company interview, I reminded him that I also worship at the church of Catholic Mass, as do the vast majority of the Mexican immigrants. These faith-based folks would create a new blue-collar middle class that is sorely needed in this country if we let them.

They would also finance Social Security over the next fifty years. Though it should be noted that academic research shows that 2/3rds of them pay Social Security with phony ID cards and will never receive the benefit as matters now stand. And, of course, they pay the sales tax on whatever purchases they make in stores.

The problem will never be solved unless we legally permit roughly 400,000 per year to fill the demand for U.S. jobs that are currently available. This resembles the Bracero Program and it must be part of any solution. It’s just plain common sense that at any given productivity rate, a larger labor force generates more GDP growth to the benefit of the U.S. economy. During the high tide of immigration, over the past twenty years, the U.S. has enjoyed unrivaled prosperity at low unemployment. So, again, I ask, if immigration is so bad, then why are things so good?

Yes, there should be tough border security. Yes, there should be foolproof ID cards, with biometrics, for Social Security and employment purposes. Former Sen. Alan Simpson of Wyoming, the co-author of the 1986 Simpson-Mazzoli immigration reform bill, has said the failure of that bill was a function of the lack of an ID card system.

But the intransigence of the Tancredo-Buchanan crowd is a remarkable political event which is all out of kilter with poll after poll that shows a substantial majority of respondents favor broad based immigration reform.

If these guys win, the Republican Party loses, and the nation loses. Unlike the big countries of Western Europe and Japan, the U.S. benefits from immigration that keeps our population rising. (In fact, harking back to the Catholic Mass, roughly 45 million unborn children have been killed since the abortion wave was launched by Roe v. Wade in the early 1970’s. We have an opportunity to replace this extraordinary loss of human life with hard headed but compassionate and economically sound immigration reform).

Incidentally, I wrote the article for Human Events when that newspaper awarded Congressman Pence its “2005 Man of the Year” award. I know Mike. The man is a wonderful, Reagan-thinking conservative. His life is governed by religious values, a belief in a strong national defense, and a pro-growth approach to low taxes and less government spending.

This Tancredo-Buchanan backstabbing does this rising GOP star a great disservice. If allowed to go unanswered, it would represent another devastating blow to the Republican Party.

While the Pence-Hutchinson immigration reform idea is not perfect, it does represent a useful discussion point for future action. As diplomatically and kindly as possible, with all the greatest respect for differing points of view, let me just say that the Tancredo-Buchanan attack on Mike Pence is nuttier than a fruitcake.

Monday, August 28, 2006

Kudlow's Stock Club

Twice a week, on Tuesdays and Fridays, our investment segment on CNBC’s Kudlow and Company, will feature the "Kudlow Stock Club" selection of various investment ideas. No, they are not my stock picks; these recommendations come from our four and five star Morningstar rated portfolio managers—an elite club of investors with excellent track records down through the years.

Twice a week, on Tuesdays and Fridays, our investment segment on CNBC’s Kudlow and Company, will feature the "Kudlow Stock Club" selection of various investment ideas. No, they are not my stock picks; these recommendations come from our four and five star Morningstar rated portfolio managers—an elite club of investors with excellent track records down through the years. Here are the picks from Friday night's program:

David Sowerby, portfolio manager at Loomis Sayles & Company – (Mr. Sowerby is up 6 percent YTD, S&P up 3 ½)

ConocoPhillips COP

Franklin Resources BEN

Bear Stearns BSC

Abbott Labs ABT

Burlington Northern BNI

Texas Instruments TXN

Harris Corp HRS

Hewlett-Packard HPQ

Wyndham Worldwide WYN

Molson Coors TAP

Barry James, CFA, CIC is President and Portfolio Manager with James Investment Research, and President of the James Advantage Funds. (He's up 3 percent YTD)

McDonald’s MCD

PolyOne Corp POL

Merck MRK

Archer Daniels Midland ADM

American Physicians Capital ACAP

Goldman Sachs GS

Hewlett-Packard HPQ

Alliant Energy LNT

American Electric Power (AEP)

Valero Energy (VLO)

Bernanke’s Hail Mary

Ben Bernanke didn’t talk about the Fed’s money policy in his speech at the big Fed summit in Jackson Hole, Wyoming last Friday. Instead, the former Princeton economics professor, now the nation’s new money maestro, spoke on the benefits of global free trade and globalization. But in terms of money creation, which is the Fed’s primary job, the new maestro has put the screws on.

This year the high-powered monetary base has flat-lined, compared to 6 percent growth last year. This means, the central bank has stopped creating new money, a decidedly counter-inflationary move that is stabilizing the value of those greenbacks in your wallets and purses.

This 2006 tight money Fed policy is also reducing expectations of future inflation, according to a number of inflation-sensitive market price indicators.

To wit: long-term bond rates have dropped to 4.80 percent from 5.25 percent earlier this summer. The Treasury market yield curve now is inverted, meaning that long-term rates are below short-term rates, an unnatural shape that signifies tight money. Gold prices around $625 are about a hundred bucks less than their peak last spring.

And here’s another interesting sideline to this story: unleaded gas futures prices have slipped down to $1.79, as Hurricane Ernesto fizzles. My rule of thumb, connecting pump prices to the futures market, is to simply add a dollar for taxes and carrying charges. This means pump prices head to $2.79 in a few weeks, another thirteen cents or so from current national averages. There’s Republican mid-term congressional election content in these numbers.

Putting all this together, inflation will remain under control as Ben Bernanke’s global economy keeps producing more goods to absorb a less accommodative money supply. This is right out of Milton Friedman’s playbook, as recently discussed by Art Laffer in last week’s Wall Street Journal.

Finally, stock markets are moving back to their five-year highs, a signal that investors are voting for a continued economic growth scenario rather than a recession. The Investor Class likes what maestro Bernanke is doing, and strongly suspects that the Fed’s highly watched target rate—now 5.25 percent—will not be raised anymore this year.

Give Bernanke credit. And say a Hail Mary for the GOP.

This year the high-powered monetary base has flat-lined, compared to 6 percent growth last year. This means, the central bank has stopped creating new money, a decidedly counter-inflationary move that is stabilizing the value of those greenbacks in your wallets and purses.

This 2006 tight money Fed policy is also reducing expectations of future inflation, according to a number of inflation-sensitive market price indicators.

To wit: long-term bond rates have dropped to 4.80 percent from 5.25 percent earlier this summer. The Treasury market yield curve now is inverted, meaning that long-term rates are below short-term rates, an unnatural shape that signifies tight money. Gold prices around $625 are about a hundred bucks less than their peak last spring.

And here’s another interesting sideline to this story: unleaded gas futures prices have slipped down to $1.79, as Hurricane Ernesto fizzles. My rule of thumb, connecting pump prices to the futures market, is to simply add a dollar for taxes and carrying charges. This means pump prices head to $2.79 in a few weeks, another thirteen cents or so from current national averages. There’s Republican mid-term congressional election content in these numbers.

Putting all this together, inflation will remain under control as Ben Bernanke’s global economy keeps producing more goods to absorb a less accommodative money supply. This is right out of Milton Friedman’s playbook, as recently discussed by Art Laffer in last week’s Wall Street Journal.

Finally, stock markets are moving back to their five-year highs, a signal that investors are voting for a continued economic growth scenario rather than a recession. The Investor Class likes what maestro Bernanke is doing, and strongly suspects that the Fed’s highly watched target rate—now 5.25 percent—will not be raised anymore this year.

Give Bernanke credit. And say a Hail Mary for the GOP.

Friday, August 25, 2006

The Price is Too High?

From Reuters:

The American Civil Liberties Union and a leading Islamic group (CAIR) on Wednesday accused security officials at New York's JFK airport of racially profiling Muslims.

"The price to pay for racial profiling is too high," Dennis Parker of the American Civil Liberties Union told a news conference. "All people should be treated in the same way regardless of their race, their ethnicity or their religion."

The American Civil Liberties Union and a leading Islamic group (CAIR) on Wednesday accused security officials at New York's JFK airport of racially profiling Muslims.

"The price to pay for racial profiling is too high," Dennis Parker of the American Civil Liberties Union told a news conference. "All people should be treated in the same way regardless of their race, their ethnicity or their religion."

Soviet Style Central Planning

Unfortunately, it’s beginning to look like two of Washington’s major institutions (The Fed & the CBO) want to sabotage the American economy.

Unfortunately, it’s beginning to look like two of Washington’s major institutions (The Fed & the CBO) want to sabotage the American economy. Let’s start with the Fed’s goofy sacrifice ratio, which basically refers to how much unemployment has to go up in order to bring inflation down. I call this economic garbage the "Phillips curve in drag," because over the last 25 years, unemployment and inflation have actually moved in tandem and they have both moved down.

In other words, as inflation slows, unemployment comes down because the economy is strong. (If you look at their relationship during the 1970s, you would see unemployment and inflation both moving higher.)

The fact is, strong growth coexists rather nicely with low inflation. And since inflation is too much money chasing too few goods, then if you're producing more goods that absorb the money supply, especially with low tax rates to produce more goods, then why should we fear growth?

But let's not forget that misguided bunch over at the Congressional Budget Office. These folks are telling Congress that only higher taxes in the next ten years will balance the budget. Huh?

This crowd actually believes that President Bush’s tax cuts will trigger a $1.7 trillion budget hole in the next decade. The reality is that in the last couple of years since they were implemented, there have been huge revenue gains rolling in to the Treasury from the strong economy.

As it stands, the Fed’s sacrifice ratio model is simply running amok, and so is the CBO’s absurd tax hike/deficit model. Between these two genius institutions, they could destroy the economy with their bizarre logic.

What is it that causes Washington to work overtime to stop prosperity?

I don’t get it.

Majority of Brits Fear Islam

From the Daily Telegraph:

From the Daily Telegraph:The alleged plot to blow up transatlantic airliners and last year's terrorist attacks on London have made more people fear Islam as a religion, not merely its extremist elements, a poll for The Daily Telegraph has found.

A growing number of people fear that the country faces "a Muslim problem" and more than half of the respondents to the YouGov survey said that Islam posed a threat to Western liberal democracy. That compares with less than a third after the September 11 terrorist attacks on America five years ago...

...there has been a substantial increase over the past five years in the numbers who appear to subscribe to a belief in a clash of civilisations. When YouGov asked in 2001 whether people felt threatened by Islam, as distinct from fundamentalist Islamists, only 32 per cent said they did. That figure has risen to 53 per cent.

Five years ago, a majority of two to one thought that Islam posed no threat, or only a negligible one, to democracy. Now, by a similar ratio, people think it is a serious threat.

Thursday, August 24, 2006

"New Yorker arrested for broadcasting Hizbollah TV"

From Reuters:

U.S. authorities have arrested a New York man for broadcasting Hizbollah television station al-Manar, which has been designated a terrorist entity by the U.S. Treasury Department, prosecutors said on Thursday.

Javed Iqbal, 42, was arrested on Wednesday because his Brooklyn-based company HDTV Ltd. was providing New York-area customers with the Hizbollah-operated channel, federal prosecutors said in a statement...

Good.

(Note to Authorities: Throw out all the anti-American Imams while you're at it.)

U.S. authorities have arrested a New York man for broadcasting Hizbollah television station al-Manar, which has been designated a terrorist entity by the U.S. Treasury Department, prosecutors said on Thursday.

Javed Iqbal, 42, was arrested on Wednesday because his Brooklyn-based company HDTV Ltd. was providing New York-area customers with the Hizbollah-operated channel, federal prosecutors said in a statement...

Good.

(Note to Authorities: Throw out all the anti-American Imams while you're at it.)

Tonight's Lineup

On CNBC's Kudlow & Company this evening:

On CNBC's Kudlow & Company this evening:Rep. Barney Frank (D-MA) will square off with conservative commentator Ann Coulter on myriad subjects including homeland security, immigration, and the economy.

Tim Strazzini, independent trader/CNBC’s “Fast Money” contributor and MarketWatch Senior Columnist Herb Greenberg will discuss the markets and offer some perspective on Viacom/Paramount and Sumner Redstone's flare-up with Tom Cruise.

CNBC's Tyler Mathisen will discuss the latest business headlines.

An economic debate on the Fed, recession fears, and the sacrifice ratio with Brian Wesbury, Chief Economist for First Trust Advisors; Jared Bernstein, senior economist at the Economic Policy Institute; and David Kotok, Chairman and Chief Investment Officer Cumberland Advisors.

Business Produces

Will business pick up the economic slack created by the housing drag? That’s the big question separating economic optimists from the cult of the bear. Well, today’s factory report on the production of durable goods answers that question with an emphatic yes.

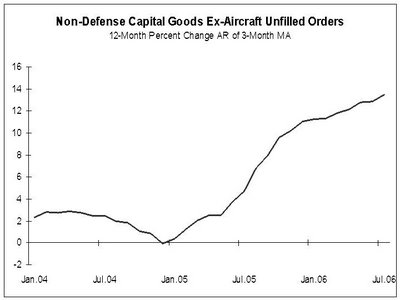

Spurred by record profits and low tax rates on capital, business other than the ailing Ford and GM looks really strong. Major categories of new orders, shipments, and unfilled orders for non-defense non-aircraft capital goods surged in July at a double digit annualized pace. Over the past year, orders are up 13 percent, shipments increased 10 percent, and backlogs rose 14 percent. These are very big numbers.

Economic pessimists and recessionists will have to go back to the drawing board. Incidentally, 3rd quarter GDP, reported just before the November election, will likely come in within the 3 to 3 ½ percent zone.

There’s no question that the housing boom is leveling off. But supply-siders know that it is business that creates jobs and consumer incomes for spending.

July retail sales were very strong, showing a resilient consumer. So was industrial production outside of autos, and today’s factory report confirms this. What the pessimists miss is that the U.S. economy is a very durable, resilient, and flexible free-market capitalist organism. Resources like capital and labor are always shifting from weak areas to stronger ones.

It is also worth noting that while housing construction is in the doldrums, business building of plants, equipment, office buildings and shopping stores is booming.

Congressional Republicans should heed President Bush’s advice by emphasizing the strong low tax economy. And here’s an added bonus for that argument: gas prices in the futures markets are falling on a daily basis. Pump prices are just beginning to reflect this. By the time we get to November, pump prices could be down to $2.75.

Think of it.

Spurred by record profits and low tax rates on capital, business other than the ailing Ford and GM looks really strong. Major categories of new orders, shipments, and unfilled orders for non-defense non-aircraft capital goods surged in July at a double digit annualized pace. Over the past year, orders are up 13 percent, shipments increased 10 percent, and backlogs rose 14 percent. These are very big numbers.

Economic pessimists and recessionists will have to go back to the drawing board. Incidentally, 3rd quarter GDP, reported just before the November election, will likely come in within the 3 to 3 ½ percent zone.

There’s no question that the housing boom is leveling off. But supply-siders know that it is business that creates jobs and consumer incomes for spending.

July retail sales were very strong, showing a resilient consumer. So was industrial production outside of autos, and today’s factory report confirms this. What the pessimists miss is that the U.S. economy is a very durable, resilient, and flexible free-market capitalist organism. Resources like capital and labor are always shifting from weak areas to stronger ones.

It is also worth noting that while housing construction is in the doldrums, business building of plants, equipment, office buildings and shopping stores is booming.

Congressional Republicans should heed President Bush’s advice by emphasizing the strong low tax economy. And here’s an added bonus for that argument: gas prices in the futures markets are falling on a daily basis. Pump prices are just beginning to reflect this. By the time we get to November, pump prices could be down to $2.75.

Think of it.

Privatized Canadian Health Care?

From North of the Border...

Canadian doctors have given their blessing to patients having the option of purchasing private health insurance as a possible solution to the problem of not getting timely medically necessary treatment in the public system...

Canadian doctors have given their blessing to patients having the option of purchasing private health insurance as a possible solution to the problem of not getting timely medically necessary treatment in the public system...

Wednesday, August 23, 2006

History Shows Tax Cuts Work

Superb article by Richard Rahn in today's Washington Times ("Tax cut revenue rewards").

Many in the Washington establishment were shocked Aug. 17, when the Congressional Budget Office reported a surge of "unanticipated tax receipts" that will sharply push down this year's deficit. Those who had been proclaiming the Bush tax rate cuts would result in a big reduction in tax revenues tried to hide their disappointment. It was tough being proved wrong again after having said the same thing when Ronald Reagan cut tax rates in the early 1980s.

We have now had three major experiments with tax rate reduction in the last half-century, and each time both economic growth and tax revenues have surged, despite the fears and cries of the anti-tax-cut crowd. How much more evidence will they need to understand the difference between tax rates and tax revenues? Most everyone, including most members of Congress, can understand that properly structured tax rate reduction, by decreasing the impediments to working, saving and investing, will lead to a higher rate of economic growth. Why then is it so difficult to understand that a bigger economic pie can lead to more tax revenue rather than less? ...

Click here to finish the article.

Many in the Washington establishment were shocked Aug. 17, when the Congressional Budget Office reported a surge of "unanticipated tax receipts" that will sharply push down this year's deficit. Those who had been proclaiming the Bush tax rate cuts would result in a big reduction in tax revenues tried to hide their disappointment. It was tough being proved wrong again after having said the same thing when Ronald Reagan cut tax rates in the early 1980s.

We have now had three major experiments with tax rate reduction in the last half-century, and each time both economic growth and tax revenues have surged, despite the fears and cries of the anti-tax-cut crowd. How much more evidence will they need to understand the difference between tax rates and tax revenues? Most everyone, including most members of Congress, can understand that properly structured tax rate reduction, by decreasing the impediments to working, saving and investing, will lead to a higher rate of economic growth. Why then is it so difficult to understand that a bigger economic pie can lead to more tax revenue rather than less? ...

Click here to finish the article.

Radio Interview with Hugh Hewitt

(The following is a transcript from my weekly appearance on Hugh Hewitt's national radio show. Yours truly is a guest on Hugh's show every Friday night at 7:20pm ET. If you'd like to listen to the transcript from this past Friday's broadcast, click here.)

HH: This is rapidly becoming my favorite segment of the week, because Larry Kudlow cuts through the crap, and just gets to the bottom line when it comes to the economy. Larry Kudlow, interest rates on the 10 year dropped below 5%. The overnight is at 5 1/4. What's going on?

LK: Mortgage rates fell big. Mortgage rates are falling, I think, three or four consecutive weeks. Mortgage rates are falling. Energy prices are falling. Gasoline prices in the open market dropped under $2.00 to $1.95. If you add a buck for taxes and carrying charge, it tells you that across the nation, we're going to hit a $2.95 cent average gas price. That gets it below $3 bucks. NASDAQ tech stocks, Hugh, had their best week in four years. And the overall averages were all up. We are approaching, again, the highs, the five year highs, that were registered in early May. It is the greatest story never told, including the underlying economy, including the tax cuts, which George Bush talked about at Camp David today. It's a good story, and the cacophony of all these complaining, cults of the brear people is being put to rout.

HH: Let me talk to you a little bit, Larry Kudlow, about specific advice for people listening, and then get back to the macro. If you've got cash on the sidelines, and you want to park it in a mutual fund, where does Larry Kudlow tell you to look?

LK: You know, I always say buy the broad-based indexes. Buy the indexed fund for the S&P 500, buy the indexed fund for the Wilshire 5,000. You get all the major traded stocks in America. Essentially, you're buying a piece of the rock in this country's long-run economy. That's where they should go. If they're not professionals, believe me, you can't be picking and choosing, and buying and selling, and trading and day trading. Better off to buy the broadest indexes, and it's cheap. These index funds cost you about $.25 cents on the dollar. It is the best way to participate in this stock market, which by the way, is heating up, and it's going to bust through all the highs, you wait and see, by the end of this year, or early next.

HH: Now Larry, I always get questions, that say Hugh, I'm in the investor's class. I'm in an investment club. I want specifics from Larry Kudlow. And so, if they are doing the $100 dollars a month, and they're picking stocks because it's fun, what do you tell them to do?

LK: Well, that's an interesting question. That's a very interesting question. You know, when you look down the list, you see some very interesting things right now. You see, for example, some of the retailers, which have done very poorly, are having a nice little comeback, like this week, Circuit City was up 11%.

HH: Oh.

LK: Nordstroms was up 7%. Federated was up 4%. Even Amazon.com was up 4% this week. Now that stuff has been clobbered, and people have shunned it. I would go back to it. I'll tell you another one. Semiconductor companies...this week, AMD, which is kind of the new Intel, was up 21%. Broadcom was up 20%. Marvel Technologies was up 8%. Some of the communications companies...these are the equipment builders, because you know, the telephone companies are doing fiber optic buildouts to do internet telephony, and they're doing buildouts in order to get a piece of the television business. So what you're seeing...and the cable companies, by the way, are having to redo their own fiber optic stuff. So for example, this week, Qualcom was up 12%, and Lucent was up 9.5%. And Cisco was up 6.5%. And cell phone maker Motorola, I got my razor phone. You ought to have one, too. Motorola was up 5%. These are all very interesting little plays going on here.

HH: Hey, a programming suggestion for you, Larry.

LK: Now I'm not recommending. I'm just saying these are interesting plays. I am not the guy to recommend and pound the table. But since you asked, I'm just saying here's some hot stocks in some neglected sectors. Retail and computer chips, and communications equipment. Let me be very clear. I can't recommend them. I'm just saying this is stuff that looks like it has value.

HH: Programming for you, though. I think Larry Kudlow's stock club, that took the same kind of ethic that stock clubs around the country did on a Friday afternoon feature, would be enormously popular, because people do do this. And it's a good thing for the investor class to get together and talk about this. It's an educational process, for one thing.

LK: Well, I can only tell you that I think the growth-oriented sectors of the economy, and that...you know, let's take the consumer sector. Let's look at that for a minute. Everybody wrote the consumer off. They said the housing is slumping. That's going to kill consumers. Guess what? It hasn't. Consumers are very resilient. The great American consumer. Jobs are rising, unemployment is low, incomes are going up, tax rates are low. Consumers are showing a lot of resilience, and that's why I wouldn't write off all the consumer stocks. And incidentally, I wouldn't write off the home builders. Home builders have been smashed. Some of these great companies are down 50% for God's sakes. the home building correction is coming to an end. In fact, we saw in the 2nd quarter, home prices actually went up for a change. And while all the Wall Street consensus bears are telling you homes are getting killed, and are going to keep getting killed, if you have any contrarian blood in you, you might want to look at some of these home builders. I mean...

HH: Especially with interest rates on a glide path.

LK: Yes. Mortgage rates are coming down. For example, this week, Toll Brothers was up 5%, Lennar was up 5.5%. Pulte Homes was up 7%. Centex was up 8%. It's very interesting what's going on out there. It's counter-consensus.

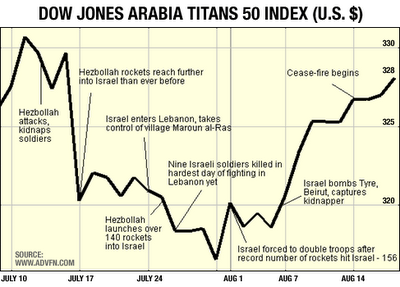

HH: Now let me ask you to go macro again. Damage to the Israeli economy. How significant?

LK: Well, they got hurt. I don't know how significant it's going to be in the longer run. I'm not sure that there's going to be all that much. I mean, I hate to say it, but they are used to this kind of buffeting.

HH: Interesting.

LK: And I would also say that the Hezbollah rockets, they've fired a lot of rockets. I'm not sure what all damage they did. I mean, they did kill some people, some families are hurt, and they had to move out. But in terms of the Israeli...you know, the Israeli economy is a technology driven economy. It's a near cousin to the NASDAQ. So it kind of trades off of the NASDAQ, and it's been in a slump just like the NASDAQ has been, but when you see the NASDAQ go up, really, to the best week in four years, and it may be that there's a revival in tech stocks, you might want to take a look at that.

HH: Thirty seconds, Larry. What about the defense industry? It's been a strong sector for a long time.

LK: Fabulous. Absolutely fabulous the last five years, up about 260%. The world is a dangerous place. I don't care who's running Congress. Military budgets are going to continue to expand. I love the defense companies. I just love them. And by the way, they're all better managed, and they apply good technology, and they're very productive. I would buy them across the board. I love defense stocks. Love them.

HH: Larry Kudlow, think about that Larry Kudlow stock club. It's a winner on Friday afternoon. I'll keep it up here. Larry, talk to you next week.

End of interview.

HH: This is rapidly becoming my favorite segment of the week, because Larry Kudlow cuts through the crap, and just gets to the bottom line when it comes to the economy. Larry Kudlow, interest rates on the 10 year dropped below 5%. The overnight is at 5 1/4. What's going on?

LK: Mortgage rates fell big. Mortgage rates are falling, I think, three or four consecutive weeks. Mortgage rates are falling. Energy prices are falling. Gasoline prices in the open market dropped under $2.00 to $1.95. If you add a buck for taxes and carrying charge, it tells you that across the nation, we're going to hit a $2.95 cent average gas price. That gets it below $3 bucks. NASDAQ tech stocks, Hugh, had their best week in four years. And the overall averages were all up. We are approaching, again, the highs, the five year highs, that were registered in early May. It is the greatest story never told, including the underlying economy, including the tax cuts, which George Bush talked about at Camp David today. It's a good story, and the cacophony of all these complaining, cults of the brear people is being put to rout.

HH: Let me talk to you a little bit, Larry Kudlow, about specific advice for people listening, and then get back to the macro. If you've got cash on the sidelines, and you want to park it in a mutual fund, where does Larry Kudlow tell you to look?

LK: You know, I always say buy the broad-based indexes. Buy the indexed fund for the S&P 500, buy the indexed fund for the Wilshire 5,000. You get all the major traded stocks in America. Essentially, you're buying a piece of the rock in this country's long-run economy. That's where they should go. If they're not professionals, believe me, you can't be picking and choosing, and buying and selling, and trading and day trading. Better off to buy the broadest indexes, and it's cheap. These index funds cost you about $.25 cents on the dollar. It is the best way to participate in this stock market, which by the way, is heating up, and it's going to bust through all the highs, you wait and see, by the end of this year, or early next.

HH: Now Larry, I always get questions, that say Hugh, I'm in the investor's class. I'm in an investment club. I want specifics from Larry Kudlow. And so, if they are doing the $100 dollars a month, and they're picking stocks because it's fun, what do you tell them to do?

LK: Well, that's an interesting question. That's a very interesting question. You know, when you look down the list, you see some very interesting things right now. You see, for example, some of the retailers, which have done very poorly, are having a nice little comeback, like this week, Circuit City was up 11%.

HH: Oh.

LK: Nordstroms was up 7%. Federated was up 4%. Even Amazon.com was up 4% this week. Now that stuff has been clobbered, and people have shunned it. I would go back to it. I'll tell you another one. Semiconductor companies...this week, AMD, which is kind of the new Intel, was up 21%. Broadcom was up 20%. Marvel Technologies was up 8%. Some of the communications companies...these are the equipment builders, because you know, the telephone companies are doing fiber optic buildouts to do internet telephony, and they're doing buildouts in order to get a piece of the television business. So what you're seeing...and the cable companies, by the way, are having to redo their own fiber optic stuff. So for example, this week, Qualcom was up 12%, and Lucent was up 9.5%. And Cisco was up 6.5%. And cell phone maker Motorola, I got my razor phone. You ought to have one, too. Motorola was up 5%. These are all very interesting little plays going on here.

HH: Hey, a programming suggestion for you, Larry.

LK: Now I'm not recommending. I'm just saying these are interesting plays. I am not the guy to recommend and pound the table. But since you asked, I'm just saying here's some hot stocks in some neglected sectors. Retail and computer chips, and communications equipment. Let me be very clear. I can't recommend them. I'm just saying this is stuff that looks like it has value.

HH: Programming for you, though. I think Larry Kudlow's stock club, that took the same kind of ethic that stock clubs around the country did on a Friday afternoon feature, would be enormously popular, because people do do this. And it's a good thing for the investor class to get together and talk about this. It's an educational process, for one thing.

LK: Well, I can only tell you that I think the growth-oriented sectors of the economy, and that...you know, let's take the consumer sector. Let's look at that for a minute. Everybody wrote the consumer off. They said the housing is slumping. That's going to kill consumers. Guess what? It hasn't. Consumers are very resilient. The great American consumer. Jobs are rising, unemployment is low, incomes are going up, tax rates are low. Consumers are showing a lot of resilience, and that's why I wouldn't write off all the consumer stocks. And incidentally, I wouldn't write off the home builders. Home builders have been smashed. Some of these great companies are down 50% for God's sakes. the home building correction is coming to an end. In fact, we saw in the 2nd quarter, home prices actually went up for a change. And while all the Wall Street consensus bears are telling you homes are getting killed, and are going to keep getting killed, if you have any contrarian blood in you, you might want to look at some of these home builders. I mean...

HH: Especially with interest rates on a glide path.

LK: Yes. Mortgage rates are coming down. For example, this week, Toll Brothers was up 5%, Lennar was up 5.5%. Pulte Homes was up 7%. Centex was up 8%. It's very interesting what's going on out there. It's counter-consensus.

HH: Now let me ask you to go macro again. Damage to the Israeli economy. How significant?

LK: Well, they got hurt. I don't know how significant it's going to be in the longer run. I'm not sure that there's going to be all that much. I mean, I hate to say it, but they are used to this kind of buffeting.

HH: Interesting.

LK: And I would also say that the Hezbollah rockets, they've fired a lot of rockets. I'm not sure what all damage they did. I mean, they did kill some people, some families are hurt, and they had to move out. But in terms of the Israeli...you know, the Israeli economy is a technology driven economy. It's a near cousin to the NASDAQ. So it kind of trades off of the NASDAQ, and it's been in a slump just like the NASDAQ has been, but when you see the NASDAQ go up, really, to the best week in four years, and it may be that there's a revival in tech stocks, you might want to take a look at that.

HH: Thirty seconds, Larry. What about the defense industry? It's been a strong sector for a long time.

LK: Fabulous. Absolutely fabulous the last five years, up about 260%. The world is a dangerous place. I don't care who's running Congress. Military budgets are going to continue to expand. I love the defense companies. I just love them. And by the way, they're all better managed, and they apply good technology, and they're very productive. I would buy them across the board. I love defense stocks. Love them.

HH: Larry Kudlow, think about that Larry Kudlow stock club. It's a winner on Friday afternoon. I'll keep it up here. Larry, talk to you next week.

End of interview.

Tuesday, August 22, 2006

The Threat We Face

(An excerpt from Thomas Sowell's literary wake-up call, "Point of No Return," available in its entirety on RealClearPolitics.)

"...What kind of people provide a market for videotaped beheadings of innocent hostages? What kind of people would throw an old man in a wheelchair off a cruise liner into the sea, simply because he was Jewish? What kind of people would fly planes into buildings to vent their hate at the cost of their own lives?

These are the kinds of people we are talking about getting nuclear weapons. And what of ourselves?

Do we understand that the world will never be the same after hate-filled fanatics gain the ability to wipe whole American cities off the face of the earth? Do we still imagine that they can be bought off, as Israel was urged to buy them off with "land for peace" -- a peace that has proved to be wholly illusory?

Even ruthless conquerors of the past, from Genghis Khan to Adolf Hitler, wanted some tangible gains for themselves or their nations -- land, wealth, dominion. What Middle East fanatics want is the destruction and humiliation of the west.

Their treatment of hostages, some of whom have been humanitarians serving the people of the Middle East, shows that what the terrorists want is to inflict the maximum pain and psychic anguish on their victims before killing them.

Once these fanatics have nuclear weapons, those victims can include you, your children and your children's children.

The terrorists need not start out by wiping our cities off the map. Chances are they would first want to force us to humiliate ourselves in whatever ways their sadistic imaginations could conceive, out of fear of their nuclear weapons.

After we, or our children and grandchildren, find ourselves living at the mercy of people with no mercy, what will future generations think of us, that we let this happen because we wanted to placate "world opinion" by not acting "unilaterally"?

We are fast approaching the point of no return."

"...What kind of people provide a market for videotaped beheadings of innocent hostages? What kind of people would throw an old man in a wheelchair off a cruise liner into the sea, simply because he was Jewish? What kind of people would fly planes into buildings to vent their hate at the cost of their own lives?

These are the kinds of people we are talking about getting nuclear weapons. And what of ourselves?

Do we understand that the world will never be the same after hate-filled fanatics gain the ability to wipe whole American cities off the face of the earth? Do we still imagine that they can be bought off, as Israel was urged to buy them off with "land for peace" -- a peace that has proved to be wholly illusory?

Even ruthless conquerors of the past, from Genghis Khan to Adolf Hitler, wanted some tangible gains for themselves or their nations -- land, wealth, dominion. What Middle East fanatics want is the destruction and humiliation of the west.

Their treatment of hostages, some of whom have been humanitarians serving the people of the Middle East, shows that what the terrorists want is to inflict the maximum pain and psychic anguish on their victims before killing them.

Once these fanatics have nuclear weapons, those victims can include you, your children and your children's children.

The terrorists need not start out by wiping our cities off the map. Chances are they would first want to force us to humiliate ourselves in whatever ways their sadistic imaginations could conceive, out of fear of their nuclear weapons.

After we, or our children and grandchildren, find ourselves living at the mercy of people with no mercy, what will future generations think of us, that we let this happen because we wanted to placate "world opinion" by not acting "unilaterally"?

We are fast approaching the point of no return."

Tonight's Lineup

On CNBC's Kudlow & Company this evening:

On CNBC's Kudlow & Company this evening:The Great Rate Debate between Michelle Girard, senior economist at RBS Greenwich Capital Management and David Goldman, Global Head of Fixed Income Research.

The inaugural edition of The Kudlow Stock Club. Keith Wirtz, President & CIO of Fifth Third Asset Management and Frank Holmes, CEO/CIO of US Global Investors will present and defend their latest stock picks.

An economic discussion with Laura Tyson, Dean of the London Business School and David Malpass, Chief Global Economist of Bear Stearns.

A political discussion with Tony Blankley of the Washington Times; former House Majority Leader Dick Armey; Larry O'Donnell, MSNBC Senior Political Analyst; and Dan Gernstein, Sen. Lieberman's communications director.

No Doomsday Yet

Although there are still a few more hours left in the day, the Islamic doomsday scenario scheduled for today, August 22, appears not to be in place. Maybe the airplane bombing terrorist threat foiled by our British cousins at MI5 and Scotland Yard was aimed at the doomsday scenario. We will always be thankful for the Brits.

But the big Internet story in recent days was the potential significance of August 22nd as a possible target date for a massive terrorist attack commemorating the return of the 12th Imam; a supposed day of reckoning for Shiites who believe that August 22nd corresponds to the end of the world.

Stock market investors were wearily eyeing the top of yesterday’s Drudge Report which featured this story. But veteran portfolio manager Mike Holland told us on Kudlow and Company last night that he didn’t believe a word of it. Blessedly, Mr. Holland looks to have gotten it right.

Stocks have been rising in recent weeks on the strength of a stronger than expected American economy, where resilient consumers and highly profitable businesses are outperforming the doom & gloom, cacophonous, cult of the bear on Wall Street.

Within shouting distance of 5-year highs, the bull market economy and stocks, backed by President Bush’s successful low tax rate program, continues to outperform the bearish consensus. It is the greatest story never told. It continues to dodge doomsday.

And then we have President Bush, under fire from both the left and the right, who very clearly communicated a strong positive vision for the upcoming congressional elections during yesterday’s news conference. Bush is attempting to take command of the election year Republican strategy to avoid a doomsday scenario this November.

He said, “Look, issues are won based on whether or not you can keep this economy strong—elections are won based on economic issues and national security issues…I'd be telling people that the Democrats will raise your taxes…I’d be running on the economy and I’d be running on national security. But since I’m not running, I can only serve as an advisor to those who are.”

The latest Gallup Poll shows Bush’s approval now at 42 percent, up from 31 percent in May. But here’s the real anti-doomsday shocker: among registered voters, the Republicans have closed a 12-point deficit on the generic congressional ballot in early last June to only 2 percentage points now, with the Dems at 47 percent and the Republicans at 45.

It may well be that the “Armageddon Imams” are actually helping the down on their luck GOP.

With terrorism on the front page, Democrats are losing ground rapidly, almost as much ground lost as the Boston Red Sox, who just got slammed for five straight games by the New York Yankees. Now that’s doomsday.

As for the rest of this story, I say keep the faith. Faith is the spirit.

But the big Internet story in recent days was the potential significance of August 22nd as a possible target date for a massive terrorist attack commemorating the return of the 12th Imam; a supposed day of reckoning for Shiites who believe that August 22nd corresponds to the end of the world.

Stock market investors were wearily eyeing the top of yesterday’s Drudge Report which featured this story. But veteran portfolio manager Mike Holland told us on Kudlow and Company last night that he didn’t believe a word of it. Blessedly, Mr. Holland looks to have gotten it right.

Stocks have been rising in recent weeks on the strength of a stronger than expected American economy, where resilient consumers and highly profitable businesses are outperforming the doom & gloom, cacophonous, cult of the bear on Wall Street.

Within shouting distance of 5-year highs, the bull market economy and stocks, backed by President Bush’s successful low tax rate program, continues to outperform the bearish consensus. It is the greatest story never told. It continues to dodge doomsday.

And then we have President Bush, under fire from both the left and the right, who very clearly communicated a strong positive vision for the upcoming congressional elections during yesterday’s news conference. Bush is attempting to take command of the election year Republican strategy to avoid a doomsday scenario this November.

He said, “Look, issues are won based on whether or not you can keep this economy strong—elections are won based on economic issues and national security issues…I'd be telling people that the Democrats will raise your taxes…I’d be running on the economy and I’d be running on national security. But since I’m not running, I can only serve as an advisor to those who are.”