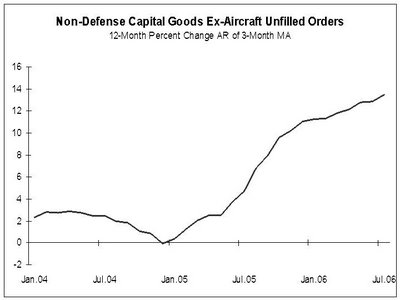

Spurred by record profits and low tax rates on capital, business other than the ailing Ford and GM looks really strong. Major categories of new orders, shipments, and unfilled orders for non-defense non-aircraft capital goods surged in July at a double digit annualized pace. Over the past year, orders are up 13 percent, shipments increased 10 percent, and backlogs rose 14 percent. These are very big numbers.

Economic pessimists and recessionists will have to go back to the drawing board. Incidentally, 3rd quarter GDP, reported just before the November election, will likely come in within the 3 to 3 ½ percent zone.

There’s no question that the housing boom is leveling off. But supply-siders know that it is business that creates jobs and consumer incomes for spending.

July retail sales were very strong, showing a resilient consumer. So was industrial production outside of autos, and today’s factory report confirms this. What the pessimists miss is that the U.S. economy is a very durable, resilient, and flexible free-market capitalist organism. Resources like capital and labor are always shifting from weak areas to stronger ones.

It is also worth noting that while housing construction is in the doldrums, business building of plants, equipment, office buildings and shopping stores is booming.

Congressional Republicans should heed President Bush’s advice by emphasizing the strong low tax economy. And here’s an added bonus for that argument: gas prices in the futures markets are falling on a daily basis. Pump prices are just beginning to reflect this. By the time we get to November, pump prices could be down to $2.75.

Think of it.