Can Ronald Reagan, Margaret Thatcher, and Milton Friedman turn back the jihadist tide?

Well, in my interview today with Secretary of State Condoleeza Rice, Ms. Rice indicated that economic and free trade diplomacy is essential in the global terror war. It may not work in some places she told me, but capitalist free trade and investment remains a very important part of the story.

She herself is working closely with new Treasury Secretary Henry Paulson—especially on China.

Ms. Rice said that spreading freedom, democracy and liberty around the world as per President Bush’s January 2005 Inaugural Speech is the backbone of her diplomacy. She agrees that un-free countries will benefit, but most importantly, so will United States security.

***To see the full interview, tune into Kudlow & Company this evening on CNBC at 5pm EST.***

Tuesday, October 31, 2006

Tonight's Lineup

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.Tonight's show will be live from Washington and will center around the interview we did today with Secretary of State Condoleeza Rice.

We'll begin with a discussion of North Korea's agreement to return to talks with China, the United States, and other countries on their nuclear weapons program.

Our Washington to Wall Street panel of experts includes:

* John Rutledge, chairman and CEO of Rutledge Capital

* P.J. Crowley, former special assistant for national security affairs

* Jed Babbin, former deputy undersecretary of defense

* Jared Bernstein, senior economist at the Economic Policy Institute

Our panel will dive into a debate on the role of investment, trade, protectionism, and economic freedom in today's world.

Rangel Calls Cheney a S.O.B. Following Our Interview

Apparently, Rep. Charlie Rangel (D-NY) was none too pleased with what Vice President Cheney told me during our interview yesterday on Kudlow & Company.

According to the front page of today's New York Post, Rangel took umbrage with Cheney's assertion that Mr. Rangel was a committed tax hiker who would not hesitate to raise taxes.

Here's what Mr. Cheney told me:

"If Charlie Rangel ends up as chairman of the Ways and Means Committee, he's said as much, that he doesn't believe there's a single one of the Bush tax cuts that ought to be extended. And I think that would be bad for the economy. I don't know if the stock market would like it. I don't think they would...So if a man like Charlie Rangel were to be chairman of the committee, and sitting there with the gavel, all he has to do is not act, just don't call up the legislation, and there'll be a big tax increase."

Here's what Rangel told the NY Post:

"He's such a real son of a bitch, he just enjoys a confrontation," Rangel fumed, describing himself as "warm and personable." Rangel said Cheney may need to go to "rehab" for "whatever personality deficit he may have suffered."

Click here to read the whole story.

According to the front page of today's New York Post, Rangel took umbrage with Cheney's assertion that Mr. Rangel was a committed tax hiker who would not hesitate to raise taxes.

Here's what Mr. Cheney told me:

"If Charlie Rangel ends up as chairman of the Ways and Means Committee, he's said as much, that he doesn't believe there's a single one of the Bush tax cuts that ought to be extended. And I think that would be bad for the economy. I don't know if the stock market would like it. I don't think they would...So if a man like Charlie Rangel were to be chairman of the committee, and sitting there with the gavel, all he has to do is not act, just don't call up the legislation, and there'll be a big tax increase."

Here's what Rangel told the NY Post:

"He's such a real son of a bitch, he just enjoys a confrontation," Rangel fumed, describing himself as "warm and personable." Rangel said Cheney may need to go to "rehab" for "whatever personality deficit he may have suffered."

Click here to read the whole story.

Secretary of State Rice on Kudlow & Company Tonight

This is my last day in Washington before heading back up to New York.

We’re going to interview Secretary of State Condoleeza Rice on tonight’ show. I plan on asking her about the ongoing challenges in Iraq as well as the danger of nuclear proliferation in Iran and North Korea.

Another topic I’d like to explore is how the global economy—in its march toward capitalism—has performed brilliantly since the horrible attacks on 9/11. Global stock markets have also performed exceptionally well.

So, is it possible that economic freedom is trumping totalitarian, jihadist, Islamic fundamentalism?

And is there a way to use economic connectivity in solving international political hotspot challenges in the darker corners of the world?

We’re going to interview Secretary of State Condoleeza Rice on tonight’ show. I plan on asking her about the ongoing challenges in Iraq as well as the danger of nuclear proliferation in Iran and North Korea.

Another topic I’d like to explore is how the global economy—in its march toward capitalism—has performed brilliantly since the horrible attacks on 9/11. Global stock markets have also performed exceptionally well.

So, is it possible that economic freedom is trumping totalitarian, jihadist, Islamic fundamentalism?

And is there a way to use economic connectivity in solving international political hotspot challenges in the darker corners of the world?

Liberal Bias?

You'll have to dig a bit to find this story in today's USA Today (it's on page 6 of the life section)

Drudge gave it top billing...

Heavy coverage at midterm favors Democrats, study says

Drudge gave it top billing...

Heavy coverage at midterm favors Democrats, study says

Monday, October 30, 2006

Tonight's Lineup

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening. The centerpiece of this evening's program will be our interview today with Vice President Cheney.

We have lined up an all-star Washington to Wall Street panel to offer its perspective on the wide range of subjects covered during the interview.

We'll cover the stock market and economy, Iraq, the upcoming elections, and much, much more. Our economic panel on tonight's program:

* Elizabeth MacDonald, Forbes magazine senior editor

* Gary Gensler, former Treasury undersecretary

* Don Luskin, Chief Investment Officer for Trend Macrolytics

* Jim Glassman, American Enterprise Institute fellow and host of Tech Central Station

Our political panel:

* Peter Beinart, editor-at-large at The New Republic

* Tony Blankley, Washington Times editorial page editor

* Frank Newport, editor-in-chief of the Gallup Poll

It's your money and your vote ladies and gentlemen - eight days left in the election countdown...

Cheney Interview

I’m down in D.C. where I just finished my interview with Vice President Cheney. We’ll air the entire interview on CNBC’s Kudlow & Company this evening.

A few highlights:

I mentioned that stocks have been going up while GOP polls have been going down, and whether the market was signaling it wants a divided government after 6 years of GOP rule. Cheney doesn’t think so. He talked about how Republicans passed the investor tax cuts - and how this has boosted the U.S. stock market and economy, and reignited growth

We discussed Charlie Rangel telling CNN this weekend that he didn’t want to raise taxes and how Nancy Pelosi told me in our interview last week that she wants tax hikes as a last resort. Despite all this, he still believes they’re tax hike threats.

Mr. Cheney took the no new tax hike pledge and although he can’t speak for the President, he believes he would veto any potential tax hike bill.

On the midterms, the Vice President was still very much optimistic for a GOP victory on November 7th.

With respect to backdating stock options: he’s concerned about this, but he’s not in favor of additional regulation on hedge funds and private equity funds. He also said he’s willing to work with Pelosi on easing the overreglation of Sarbanes-Oxley.

He was not hopeful of capturing al-Sadr whose death squad militias are causing sectarian strife throughout Iraq. Nor was he hopeful about a “big victory” event that would give hope to people like myself who want to win the war. I mentioned Vicksburg and The Battle of Midway and he basically said this isn’t that kind of war.

Tune in to the show tonight to catch the whole interview…

A few highlights:

I mentioned that stocks have been going up while GOP polls have been going down, and whether the market was signaling it wants a divided government after 6 years of GOP rule. Cheney doesn’t think so. He talked about how Republicans passed the investor tax cuts - and how this has boosted the U.S. stock market and economy, and reignited growth

We discussed Charlie Rangel telling CNN this weekend that he didn’t want to raise taxes and how Nancy Pelosi told me in our interview last week that she wants tax hikes as a last resort. Despite all this, he still believes they’re tax hike threats.

Mr. Cheney took the no new tax hike pledge and although he can’t speak for the President, he believes he would veto any potential tax hike bill.

On the midterms, the Vice President was still very much optimistic for a GOP victory on November 7th.

With respect to backdating stock options: he’s concerned about this, but he’s not in favor of additional regulation on hedge funds and private equity funds. He also said he’s willing to work with Pelosi on easing the overreglation of Sarbanes-Oxley.

He was not hopeful of capturing al-Sadr whose death squad militias are causing sectarian strife throughout Iraq. Nor was he hopeful about a “big victory” event that would give hope to people like myself who want to win the war. I mentioned Vicksburg and The Battle of Midway and he basically said this isn’t that kind of war.

Tune in to the show tonight to catch the whole interview…

CAIR Bets on Dems

From FrontPageMagazine:

With two weeks left before the November 7th election, speculation abounds about the shape of politics in Washington D.C. for the next two years. Many political commentators are expressing the view that America is about to return to the days of divided government – with a Republican in the White House and Democrats holding at least one, if not two, chambers of Congress. From all indications, America, it seems, is very evenly divided.

But for officials of the Council on American-Islamic Relations (CAIR) – the most visible group claiming to represent Muslims in America – their political loyalties appear to lean in one particular political direction. An extensive review of political contributions by CAIR officials, employees and board members on the local, state and national level reveals that CAIR is betting almost exclusively on Democrats to represent them politically on Capitol Hill during the upcoming 110th Congress...

With two weeks left before the November 7th election, speculation abounds about the shape of politics in Washington D.C. for the next two years. Many political commentators are expressing the view that America is about to return to the days of divided government – with a Republican in the White House and Democrats holding at least one, if not two, chambers of Congress. From all indications, America, it seems, is very evenly divided.

But for officials of the Council on American-Islamic Relations (CAIR) – the most visible group claiming to represent Muslims in America – their political loyalties appear to lean in one particular political direction. An extensive review of political contributions by CAIR officials, employees and board members on the local, state and national level reveals that CAIR is betting almost exclusively on Democrats to represent them politically on Capitol Hill during the upcoming 110th Congress...

Interview with Vice President Cheney Tonight

Friday, October 27, 2006

Ka-boom in VA

Judging by the action over at Tradesports, Democrat Jim Webb's heated battle in Virginia against incumbent George Allen has taken a serious turn for the worse since news broke of sexually questionable excerpts throughout Webb's novels.

As of this post:

***George Allen's contract is up a whopping 15 points. Bettors are now giving him a 75 percent chance of victory in that contest.

***Webb's contract is heading to the basement. It has plummeted 15 points, with bettors offering the beleagured candidate a 25 percent shot at the Senate seat.

As of this post:

***George Allen's contract is up a whopping 15 points. Bettors are now giving him a 75 percent chance of victory in that contest.

***Webb's contract is heading to the basement. It has plummeted 15 points, with bettors offering the beleagured candidate a 25 percent shot at the Senate seat.

Tonight's Lineup

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.We will begin tonight's show with a thorough economic discussion focusing on today's GDP report and what it means for the economy, the stock market, and the upcoming elections.

On board to discuss:

* Nouriel Roubini, Professor of economics at NYU's Stern School of Business

* David Malpass, Bear Stearns’ Chief Economist

* Arthur Laffer, Founder and CEO of Laffer Associates

* Craig Columbus, Chief market strategist, Thomson Financial

Kudlow's Stock Club: Alexander Motola, five-star Morningstar rated portfolio manager of the Thornburg Core Growth Fund will deliver his stock picks.

We're also going to dive headfirst into all the latest political news - including Jim Webb's campaign woes in Virginia, the heated Senate race in New Jersey between Kean and Menendez, and the latest on the border fence.

Our political guests include:

* Mark Plotkin, Washington Post Radio host. (Plotkin interviewed Virginia Democratic Senate candidate Jim Webb this morning on the controversy surrounding sexually questionable excerpts from Webb's novels.)

* Bill Press, Democratic strategist and political commentator

* Terry Jeffrey, editor of Human Events

* Myrna Blyth, long-time editor of Ladies Home Journal and founding editor of More

* Lanny Davis, author and White House special counsel in the Clinton administration

Be sure to tune into CNBC's Kudlow & Company this evening for all the latest Washington to Wall Street commentary...

Cesar Conda on today's GDP report:

Democrats and the mainstream media will no doubt say this is firm evidence that President Bush’s tax-cutting policies are starting to fail and that it’s time for a new policy direction. Critics also might blame the Federal Reserve for waiting too long to end its cycle of interest-rate hikes.

But these criticisms will be wrong: The ongoing economic expansion is a direct result of the sound fiscal and monetary policies of the past six years, while the current slower pace of economic growth appears to be cyclical and temporary in nature.

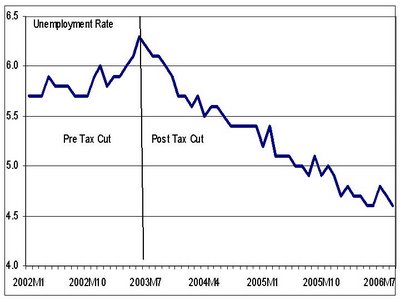

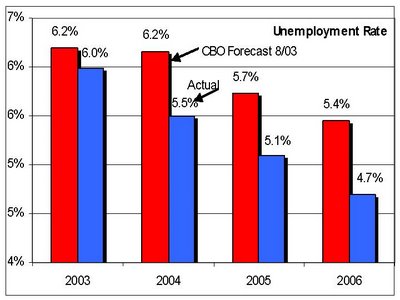

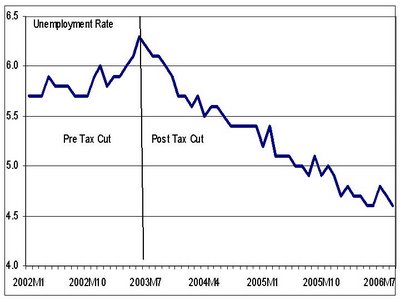

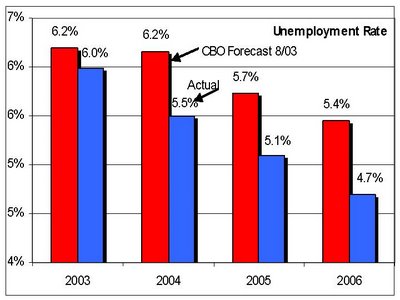

...A GDP report for one quarter is simply one quarter’s worth of data. A broad range of indicators over a longer time period provides a much more accurate picture of our economy: To wit, the U.S. economy grew 3.5 percent across the four quarters preceding the latest GDP data, the fastest pace among industrialized nations. Productivity has expanded at a strong 2.5 percent over this period, well ahead of the average productivity growth rate of the 1970s, 1980s, and 1990s. The economy has created 1.8 million new jobs over the past year and 6.6 million jobs since August 2003 — more jobs than were created in Japan and the European Union combined during this period. And the current unemployment rate of 4.6 percent sits below the average for each of the past four decades.

Democrats and the mainstream media will no doubt say this is firm evidence that President Bush’s tax-cutting policies are starting to fail and that it’s time for a new policy direction. Critics also might blame the Federal Reserve for waiting too long to end its cycle of interest-rate hikes.

But these criticisms will be wrong: The ongoing economic expansion is a direct result of the sound fiscal and monetary policies of the past six years, while the current slower pace of economic growth appears to be cyclical and temporary in nature.

...A GDP report for one quarter is simply one quarter’s worth of data. A broad range of indicators over a longer time period provides a much more accurate picture of our economy: To wit, the U.S. economy grew 3.5 percent across the four quarters preceding the latest GDP data, the fastest pace among industrialized nations. Productivity has expanded at a strong 2.5 percent over this period, well ahead of the average productivity growth rate of the 1970s, 1980s, and 1990s. The economy has created 1.8 million new jobs over the past year and 6.6 million jobs since August 2003 — more jobs than were created in Japan and the European Union combined during this period. And the current unemployment rate of 4.6 percent sits below the average for each of the past four decades.

Thursday, October 26, 2006

Democratic Move to the Center?

I'm seeing a big shift taking place right now in the in the innards - in the middle ground - of the Democratic caucus. This has been one of my mantras for several weeks now.

As Larry Sabato pointed out on tonight's show, there's somewhere north of twenty moderate to conservative Democrats poised to be elected to this new Congress. This crew is pro-business, pro-life on abortion, supported by the NRA and so forth.

Get this: Over thirty of the Democratic candidates for the House are conservative enough to have been green-lighted by the Blue Dogs or the centrist Democratic Leadership Council.

This remarkable shift has been flying largely underneath the radar screen of most of the press.

The Los Angeles Times caught on to this shift and ran a piece on this very subject this morning.

From today's paper:

He is pro-business and antiabortion. He is an evangelical Christian and an avid hunter. But, unexpectedly, Heath Shuler is a Democrat, and he is running for Congress in North Carolina.

Shuler is part of a phalanx of unusually conservative Democratic candidates who may deliver crucial victories over GOP incumbents and help their party win control of the House....

Of course, if the Democrats win control of the House, the old liberal guard will run the important committees. But underneath the rusty, old guard appears to be an increasingly conservative bunch of Democrats.

This is a very good thing for the American people.

As Larry Sabato pointed out on tonight's show, there's somewhere north of twenty moderate to conservative Democrats poised to be elected to this new Congress. This crew is pro-business, pro-life on abortion, supported by the NRA and so forth.

Get this: Over thirty of the Democratic candidates for the House are conservative enough to have been green-lighted by the Blue Dogs or the centrist Democratic Leadership Council.

This remarkable shift has been flying largely underneath the radar screen of most of the press.

The Los Angeles Times caught on to this shift and ran a piece on this very subject this morning.

From today's paper:

He is pro-business and antiabortion. He is an evangelical Christian and an avid hunter. But, unexpectedly, Heath Shuler is a Democrat, and he is running for Congress in North Carolina.

Shuler is part of a phalanx of unusually conservative Democratic candidates who may deliver crucial victories over GOP incumbents and help their party win control of the House....

Of course, if the Democrats win control of the House, the old liberal guard will run the important committees. But underneath the rusty, old guard appears to be an increasingly conservative bunch of Democrats.

This is a very good thing for the American people.

Tonight's Lineup

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.We'll begin tonight's show with a look at the stock market and economy. Our market guests this evening:

* Brian Wesbury, chief economist at First Trust Advisors

* Russ Koesterich, portfolio manager at Barclays Global Investors

* Robert Shiller, Professor of Economics at Yale University and author of Irrational Exuberance

Congressman Harold Ford (D-TN), who's running a heated race against Bob Corker in The Volunteer State, will discuss all the latest in his election battle. (Make sure to check out today's front-page WSJ article on Mr. Ford and the changing Southern political landscape.)

Our political panel will weigh in on variety of topics including the latest developments in the midterms. On board:

* Leslie Marshall, liberal radio talk show host

* Julian Epstein, Democratic strategist

* Michael Smerconish, conservative radio talk show host

* Larry Sabato, political scientist at the Univeristy of Virginia

A Washington to Wall Street debate on the economy, politics, and more. Tonight will be a battle between former Treasury undersecretary Gary Gensler and Jim Glassman, a fellow at the American Enterprise Institute and host of TechCentralStation.com. (The plan is to have these two duke it out each week, similar to our dynamic duo of Robert Reich and Steve Moore.)

It's your money. It's your vote. 12 Days left till November 7th...

Rove Begs to Differ

I ran into Karl Rove yesterday afternoon while standing in the hallway of the West Wing after our Oval Office meeting with President Bush. I asked the President’s senior adviser if he thought Republicans could still take the House.

Rove looked at me straight in the eye, and without missing a beat he responded “absolutely.”

Virtually all the latest polls have been incredibly bearish for the GOP’s midterm prospects. Zogby, Gallup, you name it - they’re all predicting major losses for Republicans.

Talking heads are no longer debating whether the GOP loses the House, but by how many seats. Over on the Senate side, while things aren’t nearly as doom and gloom, a number of pollsters and commentators think the Dems have a good shot of capturing control.

Rove thinks they’re all wrong.

We shall see.

Rove looked at me straight in the eye, and without missing a beat he responded “absolutely.”

Virtually all the latest polls have been incredibly bearish for the GOP’s midterm prospects. Zogby, Gallup, you name it - they’re all predicting major losses for Republicans.

Talking heads are no longer debating whether the GOP loses the House, but by how many seats. Over on the Senate side, while things aren’t nearly as doom and gloom, a number of pollsters and commentators think the Dems have a good shot of capturing control.

Rove thinks they’re all wrong.

We shall see.

Kill Sadr

Investors Business Daily and Ralph Peters both nailed it today—absolutely nailed it:

Time to get that fat boy Muqtada al-Sadr.

IBD editorial: …Sadr now has more than 5,000 men under arms, according to U.S. intelligence estimates. And as it turns out, Sadr is a major client of Iran's extremist mullahs. He'll keep sending young Iraqi Shiites to their death on behalf of a foreign power — particularly if it means destroying any chance Iraq has of being a stable democracy…

Peters in the New York Post:

The first thing we need to do is to kill Muqtada al-Sadr, who's now a greater threat to our strategic goals than Osama bin Laden.

We should've killed him in 2003, when he first embarked upon his murder campaign. But our leaders were afraid of provoking riots.

… Our policy of all-carrots-no-sticks has failed miserably. We delivered Iraq to zealots, gangsters and terrorists. Now our only hope is to prove that we mean business - that the era of peace, love and wasting American lives is over.

And after we've killed Muqtada and destroyed his Mahdi Army, we need to go after the Sunni insurgents. If we can't leave a democracy behind, we should at least leave the corpses of our enemies.

The holier-than-thou response to this proposal is predictable: "We can't kill our way out of this situation!" Well, boo-hoo. Friendly persuasion and billions of dollars haven't done the job. Give therapeutic violence a chance....

Count me in my friend Ralph Peters' camp.

We need to send that murderous, anti-American jerk to jail—or, better yet, send him a one-way ticket to his 72 virgins in Never-Never land.

How is it possible that this miscreant, who has been nothing but trouble, who has been working around the clock to sow seeds of murder, mayhem and unrest, fomenting war against Sunnis, etc, etc, is still on the lam?

This is a major flaw in the operation. I just don’t get it.

Time to get that fat boy Muqtada al-Sadr.

IBD editorial: …Sadr now has more than 5,000 men under arms, according to U.S. intelligence estimates. And as it turns out, Sadr is a major client of Iran's extremist mullahs. He'll keep sending young Iraqi Shiites to their death on behalf of a foreign power — particularly if it means destroying any chance Iraq has of being a stable democracy…

Peters in the New York Post:

The first thing we need to do is to kill Muqtada al-Sadr, who's now a greater threat to our strategic goals than Osama bin Laden.

We should've killed him in 2003, when he first embarked upon his murder campaign. But our leaders were afraid of provoking riots.

… Our policy of all-carrots-no-sticks has failed miserably. We delivered Iraq to zealots, gangsters and terrorists. Now our only hope is to prove that we mean business - that the era of peace, love and wasting American lives is over.

And after we've killed Muqtada and destroyed his Mahdi Army, we need to go after the Sunni insurgents. If we can't leave a democracy behind, we should at least leave the corpses of our enemies.

The holier-than-thou response to this proposal is predictable: "We can't kill our way out of this situation!" Well, boo-hoo. Friendly persuasion and billions of dollars haven't done the job. Give therapeutic violence a chance....

Count me in my friend Ralph Peters' camp.

We need to send that murderous, anti-American jerk to jail—or, better yet, send him a one-way ticket to his 72 virgins in Never-Never land.

How is it possible that this miscreant, who has been nothing but trouble, who has been working around the clock to sow seeds of murder, mayhem and unrest, fomenting war against Sunnis, etc, etc, is still on the lam?

This is a major flaw in the operation. I just don’t get it.

Wednesday, October 25, 2006

Tonight's Lineup

***CNBC'S KUDLOW & COMPANY WILL BROADCAST LIVE AT 5PM FROM WASHINGTON THIS EVENING FOLLOWING THIS AFTERNOON'S MEETING WITH PRESIDENT BUSH...

***CNBC'S KUDLOW & COMPANY WILL BROADCAST LIVE AT 5PM FROM WASHINGTON THIS EVENING FOLLOWING THIS AFTERNOON'S MEETING WITH PRESIDENT BUSH...On tonight's Washington to Wall Street program:

A look at today's Fed's action, the economy and the stock market. On board:

* John Augustine, Chief Investment Strategist at Fifth Third Asset Management

* Joe LaVorgna, Chief US Fixed Income Economist at Deutsche Bank

* Lawrence Mishel, president of the Economic Policy Institute

* Steve Moore, senior economics writer for The Wall Street Journal

A look at the situation in Iraq with President Clinton’s former national security aide P.J. Crowley, and Ian Bremmer, president of Eurasia Group, a political risk consulting firm.

Former House Majority Leader Dick Armey will debate politics and the midterm elections with Ted Rall, liberal editorial cartoonist.

And finally, a Berkeley student debate (check out the WSJ's recent article) between Josiah Prendergast, President of Berkeley College Republicans and Suzanne Reucker, President of Cal-Berkeley Democrats.

IT'S YOUR MONEY & YOUR VOTE: DAY 13 IN THE ELECTION COUNTDOWN...

A headline at Drudge:

*Defiant PM Disavows Timetable...

U.S. and Iraqi forces raided the stronghold of a Shiite militia led by a radical anti-American cleric in search of a death squad leader in an operation disavowed by Prime Minister Nouri al-Maliki.

Al-Maliki, who relies on political support from the cleric Muqtada al- Sadr, said the strike against a figure in al-Sadr's Mahdi militia in Sadr City "will not be repeated."

The defiant al-Maliki also slammed the top U.S. military and diplomatic representatives in Iraq for saying his government needed to set a timetable to curb violence in the country...

"[N]o one has the right to impose a timetable on it," al-Maliki said at a news conference....

Huh?

Who is this guy??

*Defiant PM Disavows Timetable...

U.S. and Iraqi forces raided the stronghold of a Shiite militia led by a radical anti-American cleric in search of a death squad leader in an operation disavowed by Prime Minister Nouri al-Maliki.

Al-Maliki, who relies on political support from the cleric Muqtada al- Sadr, said the strike against a figure in al-Sadr's Mahdi militia in Sadr City "will not be repeated."

The defiant al-Maliki also slammed the top U.S. military and diplomatic representatives in Iraq for saying his government needed to set a timetable to curb violence in the country...

"[N]o one has the right to impose a timetable on it," al-Maliki said at a news conference....

Huh?

Who is this guy??

Headed to the White House

I’m back in Washington.

Later this afternoon, I’ll be heading over to the White House to sit down with President Bush. Charles Krauthammer, Byron York, and a few others will meet in the West Wing to interview the President. It’ll all be on the record.

I plan to ask the President about Grover Cleveland’s veto strategy should the Dems win control November 7th. I’m sure we’ll also discuss the situation in Iraq, the midterms and the economy as well.

We’ll be doing Kudlow & Company live from the nation’s capital tonight.

It's coming down to the wire folks - less than two weeks left till the day of reckoning for Dems and Republicans…

Later this afternoon, I’ll be heading over to the White House to sit down with President Bush. Charles Krauthammer, Byron York, and a few others will meet in the West Wing to interview the President. It’ll all be on the record.

I plan to ask the President about Grover Cleveland’s veto strategy should the Dems win control November 7th. I’m sure we’ll also discuss the situation in Iraq, the midterms and the economy as well.

We’ll be doing Kudlow & Company live from the nation’s capital tonight.

It's coming down to the wire folks - less than two weeks left till the day of reckoning for Dems and Republicans…

Don't Measure the Drapes Just Yet

Some snippets from the President’s speech yesterday in Florida:

The Democrats said the tax cuts were not the solution to solving an economy that was slipping into recession. You might remember back in 2001. The truth is the tax cuts have helped make the American economy grow faster than any major industrialized nation. This economy is the envy of the world.

The Democrats said that the tax cuts would lead to a jobless recovery. The truth is that our economy has added jobs for 37 months in a row, and since August of 2003, our economy has created 6.6 million new jobs.

The Democrats said tax cuts would not help increase wages. Well, the truth is real wages have grown 2.2 percent over the last 12 months.

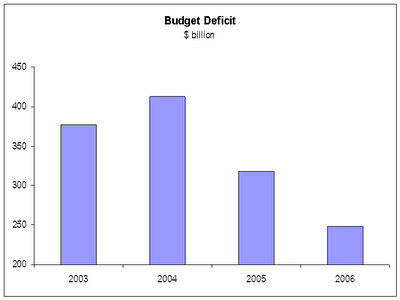

The Democrats said tax cuts would cause the deficit to explode. Well, the truth is that tax cuts led to economic growth, and that growth has helped send tax revenues soaring. And, as a result, the deficit has been cut in half three years ahead of schedule.

The Democrats have made a lot of predictions. Matter of fact, I think they may be measuring the drapes. If their electoral predictions are as reliable as their economic predictions, November 7th is going to be a good day for the Republicans.

The Democrats said the tax cuts were not the solution to solving an economy that was slipping into recession. You might remember back in 2001. The truth is the tax cuts have helped make the American economy grow faster than any major industrialized nation. This economy is the envy of the world.

The Democrats said that the tax cuts would lead to a jobless recovery. The truth is that our economy has added jobs for 37 months in a row, and since August of 2003, our economy has created 6.6 million new jobs.

The Democrats said tax cuts would not help increase wages. Well, the truth is real wages have grown 2.2 percent over the last 12 months.

The Democrats said tax cuts would cause the deficit to explode. Well, the truth is that tax cuts led to economic growth, and that growth has helped send tax revenues soaring. And, as a result, the deficit has been cut in half three years ahead of schedule.

The Democrats have made a lot of predictions. Matter of fact, I think they may be measuring the drapes. If their electoral predictions are as reliable as their economic predictions, November 7th is going to be a good day for the Republicans.

Tuesday, October 24, 2006

(Speaker?) Pelosi on Kudlow & Company Tonight

Just finished the Pelosi interview. Here are some noteworthy snippets to whet your appetite:

*** She believes we're in a Democratic bull market.

*** Dems will balance the budget.

*** Tax hikes only as a last resort.

*** It's time to get out of Iraq.

*** Oil companies should have a windfall profits tax.

Be sure to tune into this evening!

*** She believes we're in a Democratic bull market.

*** Dems will balance the budget.

*** Tax hikes only as a last resort.

*** It's time to get out of Iraq.

*** Oil companies should have a windfall profits tax.

Be sure to tune into this evening!

GOP Base Coming Home?

Dick Morris thinks so. He says control of Congress has gone from "leans Democrat" to a "toss-up":

The latest polls show something very strange and quite encouraging is happening: The Republican base seems to be coming back home. This trend, only vaguely and dimly emerging from a variety of polls, suggests that a trend may be afoot that would deny the Democrats control of the House and the Senate.

...Why are Republican fortunes brightening?

The GOP base, alienated by the Foley scandal and the generally dismal record of this Congress, may have fast forwarded to the prospect of a Democratic victory and recoiled. They may have pondered the impact of a repeal of the Patriot Act, a ban on NSA wiretapping and a requirement of having an attorney present in terrorist questioning - and decided not to punish the country for the sins of the Republican leaders....

The latest polls show something very strange and quite encouraging is happening: The Republican base seems to be coming back home. This trend, only vaguely and dimly emerging from a variety of polls, suggests that a trend may be afoot that would deny the Democrats control of the House and the Senate.

...Why are Republican fortunes brightening?

The GOP base, alienated by the Foley scandal and the generally dismal record of this Congress, may have fast forwarded to the prospect of a Democratic victory and recoiled. They may have pondered the impact of a repeal of the Patriot Act, a ban on NSA wiretapping and a requirement of having an attorney present in terrorist questioning - and decided not to punish the country for the sins of the Republican leaders....

Pelosi on Kudlow & Company Tonight

House Democratic leader Nancy Pelosi - perhaps the next speaker of the House - will join us on tonight's Kudlow & Company.

House Democratic leader Nancy Pelosi - perhaps the next speaker of the House - will join us on tonight's Kudlow & Company. We're also pleased to welcome Mark Steyn, author of "America Alone," back to the show.

Two weeks left until election day...

Ralph Peters on politically correct cowardice in today's New York Post:

I wish the world were as innocent as intellectuals pretend. But we're far from the Peaceable Kingdom. If we're unwilling to behave ferociously toward terrorists and thugs, they'll behave with greater ferocity toward the innocent. That's a consistent equation in humanity's moral algebra....

I wish the world were as innocent as intellectuals pretend. But we're far from the Peaceable Kingdom. If we're unwilling to behave ferociously toward terrorists and thugs, they'll behave with greater ferocity toward the innocent. That's a consistent equation in humanity's moral algebra....

The Australian delivered a superb editorial on multiculturalism today:

HOW tolerant must a free society be of those who are intolerant of the values it holds dear? This question is at the heart of a controversy that has flared up in Britain over the past fortnight concerning Muslim women who wear nikabs, burkas and other face coverings that allow little more than the eyes to be seen.

...At its heart is the question of where tolerance should end and the old adage, "When in Rome, do as the Romans", should kick in. While tolerance is certainly a positive virtue that should be strived for, it cannot be a cultural suicide pact. A culture that is tolerant of those who are intolerant of its freedoms is ripe for destruction, and bit by bit will see all it values eroded. And radical Islam knows this. Just as an Australian wouldn't go to Saudi Arabia to wear a bikini on the beach and drink beer in the corner pub, those who see the proper role of women as subservient, anonymous and under cover should not expect a postmodern secular democracy such as Britain or Australia to accommodate these beliefs....

HOW tolerant must a free society be of those who are intolerant of the values it holds dear? This question is at the heart of a controversy that has flared up in Britain over the past fortnight concerning Muslim women who wear nikabs, burkas and other face coverings that allow little more than the eyes to be seen.

...At its heart is the question of where tolerance should end and the old adage, "When in Rome, do as the Romans", should kick in. While tolerance is certainly a positive virtue that should be strived for, it cannot be a cultural suicide pact. A culture that is tolerant of those who are intolerant of its freedoms is ripe for destruction, and bit by bit will see all it values eroded. And radical Islam knows this. Just as an Australian wouldn't go to Saudi Arabia to wear a bikini on the beach and drink beer in the corner pub, those who see the proper role of women as subservient, anonymous and under cover should not expect a postmodern secular democracy such as Britain or Australia to accommodate these beliefs....

Monday, October 23, 2006

Midterms & the Stock Market

It may not be the Pelosi bull market after all.

The roaring stock market today is trading off yesterday’s Barron’s article that says the GOP’s money advantage will limit Democratic gains and keep the House and Senate in Republican hands.

The mainstream media is not reporting this counter-conventional poll from our friend Jim McTague—but that’s really the big news driving the market.

It’s a tempting thought that this summer and fall’s stock market rally is the most important poll predicting a Republican hold. And frankly, I would love to believe Jim Mctague’s results. But I’m still somewhat skeptical.

Tradesports’ House GOP contract is still trading in the mid 30s—no excitement there off the Barron’s story.

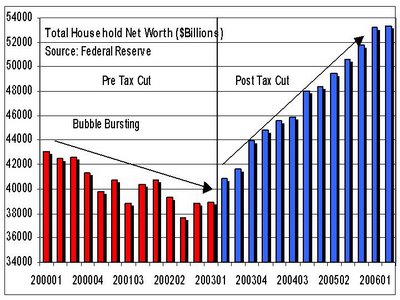

Nonetheless, let's get a big GOP bandwagon message out there. Trumpet the strong economy and the roaring stock market. Get out there and broadcast that jobs are rising, wealth is surging, and lower tax rates are working.

In short, get the investor class to the polls in droves.

The roaring stock market today is trading off yesterday’s Barron’s article that says the GOP’s money advantage will limit Democratic gains and keep the House and Senate in Republican hands.

The mainstream media is not reporting this counter-conventional poll from our friend Jim McTague—but that’s really the big news driving the market.

It’s a tempting thought that this summer and fall’s stock market rally is the most important poll predicting a Republican hold. And frankly, I would love to believe Jim Mctague’s results. But I’m still somewhat skeptical.

Tradesports’ House GOP contract is still trading in the mid 30s—no excitement there off the Barron’s story.

Nonetheless, let's get a big GOP bandwagon message out there. Trumpet the strong economy and the roaring stock market. Get out there and broadcast that jobs are rising, wealth is surging, and lower tax rates are working.

In short, get the investor class to the polls in droves.

Pay-Go and Polls: What a Predicament

From my latest syndicated column:

Most supply-siders believe that if the Democrats manage to take the House and Senate two-and-a-half weeks from now, President Bush’s investor tax cuts will be safe. First, the tax cuts already have been extended to 2010. Second, the president will surely veto any tax-hike legislation that a new Democratic Congress might pass. (Think Grover Cleveland, the greatest presidential veto-er in American history.)

Maybe so, but the political story will be more complicated, especially if a Democratic Congress passes new “pay-as-you-go” rules. This could put the tax cuts in jeopardy as early as next year.

There are essentially two kinds of pay-go. One is a spending limitation that was used by the Gingrich Congress to balance the budget in the 1990s. This would be good. The other is a revenue pay-go, which is not so good. In this scenario, if the Democrats cobbled together a big-bang deficit-reduction package, large tax hikes would be put in place to meet the new deficit targets. Since Congress scores the investor tax cuts on dividends and capital gains as static revenue losses — even though the evidence shows they pay for themselves — these tax cuts would be subject to repeal or rollback.

Should revenue pay-go materialize, President Bush might be confronted with a Hobbesian choice of vetoing a so-called $500 billion deficit-reduction package that would increase the cap-gain, dividend, and top-income-bracket tax rates.

Truth be told, the Democratic party desperately wants to return the income-tax rate to President Clinton’s 39.6 percent. It’s an obsession that’s lodged in the Democratic DNA, a class-warfare mentality that seeks to penalize the rich and soak American success. In practice, it would be a Soviet-style income-leveling exercise in the name of making the non-rich feel better.

And it’s nonsense.

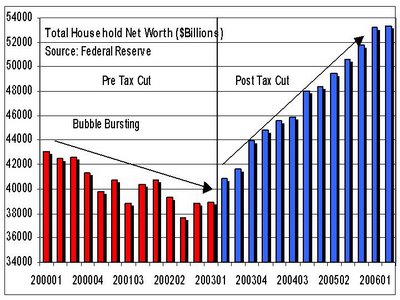

President George W. Bush’s tax cuts have done an amazing job of reigniting the U.S. economy. The 2003 tax cuts rallied the stock market, generated 6.5 million new jobs, and produced soaring revenues that have, in turn, slashed the deficit.

But all this is in peril if the new pay-go rules go through.

So let me warn my conservative friends and fellow members of the American investor class: A Democratic sweep come November 7 will put Bush’s hugely successful tax cuts on the chopping block.

It’s a sobering thought, particularly in light of sinking Republican fortunes.

On Tradesports, the online betting parlor, the House GOP 2006 contract has dropped to a new low of 32 percent. In late September, prior to the Mark Foley scandal, it had been 57 percent. Bettors, it seems, are giving up on the contract.

On the Senate side, the contract is still a 70 percent bet the Republicans will hold the upper chamber. This points to a congressional split, meaning Washington will “do no harm” on pro-growth measures, especially tax policy. But it is still possible that a phony pay-go revenue deal could surface with a coalition of House Democrats, liberal Republican Senators, and Senate Democrats.

Just as troubling is an anti-growth surge toward protectionist trade activity. The Democrats are against free trade almost uniformly, with 30 to 40 percent of Republicans considered unreliable on the subject. A Wall Street Journal story this week reveals a strong push for textile protectionism against China, Vietnam, Africa, Haiti, and South America. The supply-side growth model stresses a steady dollar, low tax rates, and free trade to promote growth. Hence, should protectionist legislation trudge forth, it would be an anti-growth lose-lose situation for the U.S. and its trading partners.

All this said, the roaring stock market remains very much in favor of a divided Congress. Republican polls are going down, and stocks are going up? Is this the Pelosi bull market? Perhaps so.

But if both chambers shift Democrat, taxes, trade, and spending may all go the wrong way. In the New York Times this week, Robert Pear details Democratic plans to control drug prices and attack health insurers and pharmaceutical companies. It’s Hillarycare all over again; a takeover of 15 percent of our economy.

President Bush’s economic approval rating has risen 5 points to 44 percent in a new Wall Street Journal/NBC News poll. Republicans should follow the president’s lead and flog away on the economy, the benefits of lower tax rates, and dropping gas prices. They also should loudly trumpet the splendid stock market rally. Indeed, across the next 18 days, this is the GOP’s best chance to generate an enthusiastic vote turnout from the investor class.

Pollster Scott Rasmussen shows that entrepreneurs (49%) and investors (46%) are the two groups most appreciative of the job the president is doing. Message to the GOP: Talk up the low-tax, Goldilocks stock market economy and get these folks to the polls.

It’s your last chance boys and girls.

Most supply-siders believe that if the Democrats manage to take the House and Senate two-and-a-half weeks from now, President Bush’s investor tax cuts will be safe. First, the tax cuts already have been extended to 2010. Second, the president will surely veto any tax-hike legislation that a new Democratic Congress might pass. (Think Grover Cleveland, the greatest presidential veto-er in American history.)

Maybe so, but the political story will be more complicated, especially if a Democratic Congress passes new “pay-as-you-go” rules. This could put the tax cuts in jeopardy as early as next year.

There are essentially two kinds of pay-go. One is a spending limitation that was used by the Gingrich Congress to balance the budget in the 1990s. This would be good. The other is a revenue pay-go, which is not so good. In this scenario, if the Democrats cobbled together a big-bang deficit-reduction package, large tax hikes would be put in place to meet the new deficit targets. Since Congress scores the investor tax cuts on dividends and capital gains as static revenue losses — even though the evidence shows they pay for themselves — these tax cuts would be subject to repeal or rollback.

Should revenue pay-go materialize, President Bush might be confronted with a Hobbesian choice of vetoing a so-called $500 billion deficit-reduction package that would increase the cap-gain, dividend, and top-income-bracket tax rates.

Truth be told, the Democratic party desperately wants to return the income-tax rate to President Clinton’s 39.6 percent. It’s an obsession that’s lodged in the Democratic DNA, a class-warfare mentality that seeks to penalize the rich and soak American success. In practice, it would be a Soviet-style income-leveling exercise in the name of making the non-rich feel better.

And it’s nonsense.

President George W. Bush’s tax cuts have done an amazing job of reigniting the U.S. economy. The 2003 tax cuts rallied the stock market, generated 6.5 million new jobs, and produced soaring revenues that have, in turn, slashed the deficit.

But all this is in peril if the new pay-go rules go through.

So let me warn my conservative friends and fellow members of the American investor class: A Democratic sweep come November 7 will put Bush’s hugely successful tax cuts on the chopping block.

It’s a sobering thought, particularly in light of sinking Republican fortunes.

On Tradesports, the online betting parlor, the House GOP 2006 contract has dropped to a new low of 32 percent. In late September, prior to the Mark Foley scandal, it had been 57 percent. Bettors, it seems, are giving up on the contract.

On the Senate side, the contract is still a 70 percent bet the Republicans will hold the upper chamber. This points to a congressional split, meaning Washington will “do no harm” on pro-growth measures, especially tax policy. But it is still possible that a phony pay-go revenue deal could surface with a coalition of House Democrats, liberal Republican Senators, and Senate Democrats.

Just as troubling is an anti-growth surge toward protectionist trade activity. The Democrats are against free trade almost uniformly, with 30 to 40 percent of Republicans considered unreliable on the subject. A Wall Street Journal story this week reveals a strong push for textile protectionism against China, Vietnam, Africa, Haiti, and South America. The supply-side growth model stresses a steady dollar, low tax rates, and free trade to promote growth. Hence, should protectionist legislation trudge forth, it would be an anti-growth lose-lose situation for the U.S. and its trading partners.

All this said, the roaring stock market remains very much in favor of a divided Congress. Republican polls are going down, and stocks are going up? Is this the Pelosi bull market? Perhaps so.

But if both chambers shift Democrat, taxes, trade, and spending may all go the wrong way. In the New York Times this week, Robert Pear details Democratic plans to control drug prices and attack health insurers and pharmaceutical companies. It’s Hillarycare all over again; a takeover of 15 percent of our economy.

President Bush’s economic approval rating has risen 5 points to 44 percent in a new Wall Street Journal/NBC News poll. Republicans should follow the president’s lead and flog away on the economy, the benefits of lower tax rates, and dropping gas prices. They also should loudly trumpet the splendid stock market rally. Indeed, across the next 18 days, this is the GOP’s best chance to generate an enthusiastic vote turnout from the investor class.

Pollster Scott Rasmussen shows that entrepreneurs (49%) and investors (46%) are the two groups most appreciative of the job the president is doing. Message to the GOP: Talk up the low-tax, Goldilocks stock market economy and get these folks to the polls.

It’s your last chance boys and girls.

Tonight's Lineup

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.We'll begin tonight's program with reaction to President Bush's CNBC interview. Our political panel includes:

* Jim McTague, columnist for Barron's Magazine, who predicts the GOP will hold on to both houses.

* Julian Epstein, Democratic strategist

* Larry Sabato, University of Virginia politcal scientist

* Kellyanne Conway, founder and president of The Polling Company

We'll explore the latest trends and developments in the stock market and economy with John Silvia, chief economist at Wachovia and Keith Wirtz, president/chief investment officer for Fifth Third Asset Management.

Jed Babbin, former deputy undersecretary of defense, will weigh in with his thoughts on the war in Iraq.

Sen. Kay Baily Hutchison (R-TX) will offer her perspective on a host of topics, including the midterm elections.

Frank Newport, editor in chief of The Gallup Poll, will bring some political clarity in our regular "Sunday Unspun" segment.

From National Review's "The Week", 11/6/06:

From National Review's "The Week", 11/6/06:A largely unreported civil war is going on in France: Arab and Muslim youth daily fight the police. At the end of last year, in many weeks of continuous and violent rioting, the police—indeed, the government—lost control of the street and have been trying to recover it ever since. No chance. This year, according to the latest count done by the Ministry of the Interior, nearly 2,500 officers have been wounded. The Muslims live in ghettoes and are largely unemployed. A high proportion either use or deal in drugs. In one such ghetto, Les Mureaux, a Paris suburb, two policemen tried to ticket a Muslim for not wearing a seatbelt. Refusing to stop, he rammed through the police car blocking his way. Hundreds of youths then stormed out of the high-rise buildings around and attacked the policemen, leaving one of them with a double-skull fracture. Spokesmen for the police speak of an intifada, and are demanding armored vehicles and water cannons to deal with it. But the politicians and media come out with their hands up, calling for more social services and affirmative action and giving permission to build ever more grandiose mosques. Pretty soon, there will be more skull fractures, if not worse.

What Will Happen

Dick Morris argues the GOP needs to sound the alarm and fill the airwaves with what will happen if the Democrats win:

Here's one possible ad: We see and hear a wiretapped conversation, with a terrorist revealing his worst plans to his associate - and, inadvertently, to government eavesdroppers, too. Then, when he's about to spill the beans on when and where the next attack is going to come, the line should go dead, with a dial tone, with a machine voice saying "This wiretap terminated in the name of privacy rights by the Democratic U.S. Congress."

The announcer can then say, "If the Democrats win, the National Security Agency will never be able to listen in as the terrorists are plotting to attack us."

Republicans are doomed unless they can get their base back. But the GOP base is the best informed group of voters in the nation, with educational levels consistently higher than their Democratic counterparts'. They follow politics closely and are the easiest voters to reach via the news media, cable TV and talk radio.

A message like this could have a snowballing effect on the Republican base. The word could percolate through the clutter, reminding voters of their true priorities....

Here's one possible ad: We see and hear a wiretapped conversation, with a terrorist revealing his worst plans to his associate - and, inadvertently, to government eavesdroppers, too. Then, when he's about to spill the beans on when and where the next attack is going to come, the line should go dead, with a dial tone, with a machine voice saying "This wiretap terminated in the name of privacy rights by the Democratic U.S. Congress."

The announcer can then say, "If the Democrats win, the National Security Agency will never be able to listen in as the terrorists are plotting to attack us."

Republicans are doomed unless they can get their base back. But the GOP base is the best informed group of voters in the nation, with educational levels consistently higher than their Democratic counterparts'. They follow politics closely and are the easiest voters to reach via the news media, cable TV and talk radio.

A message like this could have a snowballing effect on the Republican base. The word could percolate through the clutter, reminding voters of their true priorities....

Sunday, October 22, 2006

Barron's cover story:

JUBILANT DEMOCRATS SHOULD RECONSIDER their order for confetti and noisemakers. The Democrats, as widely reported, are expecting GOP-weary voters to flock to the polls in two weeks and hand them control of the House for the first time in 12 years -- and perhaps the Senate, as well. Even some Republicans privately confess that they are anticipating the election-day equivalent of Little Big Horn. Pardon our hubris, but we just don't see it.

Our analysis -- based on a race-by-race examination of campaign-finance data -- suggests that the GOP will hang on to both chambers, at least nominally. We expect the Republican majority in the House to fall by eight seats, to 224 of the chamber's 435. At the very worst, our analysis suggests, the party's loss could be as large as 14 seats, leaving a one-seat majority. But that is still a far cry from the 20-seat loss some are predicting. In the Senate, with 100 seats, we see the GOP winding up with 52, down three....

JUBILANT DEMOCRATS SHOULD RECONSIDER their order for confetti and noisemakers. The Democrats, as widely reported, are expecting GOP-weary voters to flock to the polls in two weeks and hand them control of the House for the first time in 12 years -- and perhaps the Senate, as well. Even some Republicans privately confess that they are anticipating the election-day equivalent of Little Big Horn. Pardon our hubris, but we just don't see it.

Our analysis -- based on a race-by-race examination of campaign-finance data -- suggests that the GOP will hang on to both chambers, at least nominally. We expect the Republican majority in the House to fall by eight seats, to 224 of the chamber's 435. At the very worst, our analysis suggests, the party's loss could be as large as 14 seats, leaving a one-seat majority. But that is still a far cry from the 20-seat loss some are predicting. In the Senate, with 100 seats, we see the GOP winding up with 52, down three....

Friday, October 20, 2006

Free Trade: From George to Greenspan

I was educated a protectionist and continued to believe in protection until I came to think for myself and examine the question. -Henry George

Free trade consists simply in letting people buy and sell as they want to buy and sell. Protective tariffs are as much applications of force as are blockading squadrons, and their objective is the same to prevent trade. The difference between the two is that blockading squadrons are a means whereby nations seek to prevent their enemies from trading; protective tariffs are a means whereby nations attempt to prevent their own people from trading.- Henry George, Protection or Free Trade 1886,

The evidence is overwhelmingly persuasive that the massive increase in world competition—a consequence of broadening trade flows—has fostered markedly higher standards of living for almost all countries who have participated in cross-border trade. I include most especially the United States.- Alan Greenspan, Speech, June 2, 1999.

Free trade consists simply in letting people buy and sell as they want to buy and sell. Protective tariffs are as much applications of force as are blockading squadrons, and their objective is the same to prevent trade. The difference between the two is that blockading squadrons are a means whereby nations seek to prevent their enemies from trading; protective tariffs are a means whereby nations attempt to prevent their own people from trading.- Henry George, Protection or Free Trade 1886,

The evidence is overwhelmingly persuasive that the massive increase in world competition—a consequence of broadening trade flows—has fostered markedly higher standards of living for almost all countries who have participated in cross-border trade. I include most especially the United States.- Alan Greenspan, Speech, June 2, 1999.

Tonight's Lineup

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.We'll start things off with a stock market/economic discussion. Our guests include:

** Don Luskin, Chief Investment Officer for Trend Macrolytics

** Arthur Laffer, Founder and CEO of Laffer Associates

** Robert Shiller, Yale economics professor

** Michael Crofton, Philadelphia Trust Co. President & CEO

Kudlow's Stock Club...Steve Folker, four-star Morningstar rated managing director of growth strategies at Fifth Third Asset Management, will offer his latest stock picks. (note: Mr. Folker is a return visitor - we will review his stockpicking results since his last appearance.)

A Iraq debate with Jed Babbin, former deputy undersecretary of defense.

And finally, a political roundup with:

** Peter Hart, public policy expert and CEO of Peter D. Hart Research Associates

** Sidney Blumenthal, author/former Clinton senior advisor

** David Limbaugh, conservative columnist David Limbaugh

It's your money and your vote - 18 days left in the election countdown...

Gleanings on the Midterms

The Tradesports House GOP 2006 contract has dropped several points to a new low at 32 percent. Bettors are now right at the point where they are giving up on the contract.

On the Senate side however, the contract is still a 70 percent bet on a Republican hold. So the online betting market is predicting a Congressional split. This is basically my own view that the GOP will barely hang on in the Senate, but will lose roughly 25 seats in the House.

However it’s gone down to the wire. This morning, Scott Rasmussen moved Montana Republican incumbent Conrad Burns into “toss-up” status from “leans Democrat” in his race against Tester.

A split Congress means that Washington will do no harm on pro-growth measures, especially tax policy.

However, it is still possible that a phony Pay-Go revenue deal could surface with a coalition of House Democrats, as well as liberal Republican Senators and Senate Democrats.

Presumably President Bush would then put on his Grover Cleveland hat and veto it.

More troubling is a big move toward protectionist trade activity. Dems are against free trade almost uniformly nowadays. And 30-40 percent of Republicans are unreliable on free trade.

A big WSJ story yesterday shows a strong push for textile protectionism with China, Vietnam, Africa, Haiti and South America. This would be totally anti-growth and lose-lose for the U.S. and the other nations.

Remember: the supply side growth model stresses low tax rates and free trade to promote growth, along with a steady dollar to contain inflation.

There’s no election correction in the stock market yet which is a great thing. The market will not worry about a split Congress. In fact, the stock market favors a split Congress. Think of it: Republican polls are going down, and stocks are going up. Is this the Pelosi bull market? Omygosh!

But if the Senate goes Democrat, the market will change its mind. Taxes, trade, spending, will all go the wrong way. Check out today’s Robert Pear story in the New York Times on Democratic plans to control drug prices, attack health insurers and pharmaceutical companies -- all rolling towards a Hillary-Care takeover of fifteen percent of our economy.

On the brighter side, The Wall Street Journal/NBC News poll shows a rise in President Bush’s handling of the economy where his approval has gone up 5 points to 44 percent. Republicans should be flogging away on the economy, the benefits of lower tax rates, as well as the drop in gasoline prices. And, they should be loudly trumpeting the splendid stock market rally.

This is the GOP’s very best bet in the next 18 days to rev up a big, enthusiastic turnout from the investor class.

Rasmussen shows that the two most favorable groups on President Bush’s job approval are entrepreneurs (49%) and investors (46%). Message to GOP: talk up the low tax, Goldilocks stock market and get these folks to the polls. It’s your last chance boys and girls.

On the Senate side however, the contract is still a 70 percent bet on a Republican hold. So the online betting market is predicting a Congressional split. This is basically my own view that the GOP will barely hang on in the Senate, but will lose roughly 25 seats in the House.

However it’s gone down to the wire. This morning, Scott Rasmussen moved Montana Republican incumbent Conrad Burns into “toss-up” status from “leans Democrat” in his race against Tester.

A split Congress means that Washington will do no harm on pro-growth measures, especially tax policy.

However, it is still possible that a phony Pay-Go revenue deal could surface with a coalition of House Democrats, as well as liberal Republican Senators and Senate Democrats.

Presumably President Bush would then put on his Grover Cleveland hat and veto it.

More troubling is a big move toward protectionist trade activity. Dems are against free trade almost uniformly nowadays. And 30-40 percent of Republicans are unreliable on free trade.

A big WSJ story yesterday shows a strong push for textile protectionism with China, Vietnam, Africa, Haiti and South America. This would be totally anti-growth and lose-lose for the U.S. and the other nations.

Remember: the supply side growth model stresses low tax rates and free trade to promote growth, along with a steady dollar to contain inflation.

There’s no election correction in the stock market yet which is a great thing. The market will not worry about a split Congress. In fact, the stock market favors a split Congress. Think of it: Republican polls are going down, and stocks are going up. Is this the Pelosi bull market? Omygosh!

But if the Senate goes Democrat, the market will change its mind. Taxes, trade, spending, will all go the wrong way. Check out today’s Robert Pear story in the New York Times on Democratic plans to control drug prices, attack health insurers and pharmaceutical companies -- all rolling towards a Hillary-Care takeover of fifteen percent of our economy.

On the brighter side, The Wall Street Journal/NBC News poll shows a rise in President Bush’s handling of the economy where his approval has gone up 5 points to 44 percent. Republicans should be flogging away on the economy, the benefits of lower tax rates, as well as the drop in gasoline prices. And, they should be loudly trumpeting the splendid stock market rally.

This is the GOP’s very best bet in the next 18 days to rev up a big, enthusiastic turnout from the investor class.

Rasmussen shows that the two most favorable groups on President Bush’s job approval are entrepreneurs (49%) and investors (46%). Message to GOP: talk up the low tax, Goldilocks stock market and get these folks to the polls. It’s your last chance boys and girls.

Thursday, October 19, 2006

Coup in Baghdad

An incredible Washington Times story suggests that the U.S. trained Iraqi army will overthrow Prime Minister Maliki and replace him with a strong man who would restore order while Washington looks the other way.

This coup scenario is being called Plan B.

Another Plan B scenario that might change American strategy in Iraq includes a partition of Sunnis, Shiites, and Kurdish regions.

Still another scenario is a gradual U.S. troop withdrawal.

But along the Arab political and military street there is a lot of talk about the coup overthrow scenario with Sunni generals in exile in the UAE and Saudi Arabia plotting to put a strongman in as the headman of Iraq.

Speaking of coups...

The Australian is reporting that China is getting closer to regime change in North Korea.

According to this account, there are two groups in North Korea: the royalists who support Crazy Kim and another group of Sino-philes who want to get rid of Kim Jong-il and set up a China like government in North Korea with Chinese style reforms.

Of course, this would be a very good thing. It even suggests that President Bush’s policies of Chinese diplomacy and U.N. trade sanctions might actually work. Under this coup plotting scenario, perhaps there would be economic liberalization in North Korea.

Still more on the coup front:

A source close to the Pentagon tells me that South Korean generals wish to overthrow President Roh.

Roh has consistently acted against U.S. interests and policies. He is even telling people that South Korea will not enforce the U.N. trade embargo on North Korea.

Coup plotting generals are waiting for a wink of the eye or a slight nod of the head from Mr. Rumsfeld and the U.S. Defense Department.

The generals are ready to act immediately according to this source.

This coup scenario is being called Plan B.

Another Plan B scenario that might change American strategy in Iraq includes a partition of Sunnis, Shiites, and Kurdish regions.

Still another scenario is a gradual U.S. troop withdrawal.

But along the Arab political and military street there is a lot of talk about the coup overthrow scenario with Sunni generals in exile in the UAE and Saudi Arabia plotting to put a strongman in as the headman of Iraq.

Speaking of coups...

The Australian is reporting that China is getting closer to regime change in North Korea.

According to this account, there are two groups in North Korea: the royalists who support Crazy Kim and another group of Sino-philes who want to get rid of Kim Jong-il and set up a China like government in North Korea with Chinese style reforms.

Of course, this would be a very good thing. It even suggests that President Bush’s policies of Chinese diplomacy and U.N. trade sanctions might actually work. Under this coup plotting scenario, perhaps there would be economic liberalization in North Korea.

Still more on the coup front:

A source close to the Pentagon tells me that South Korean generals wish to overthrow President Roh.

Roh has consistently acted against U.S. interests and policies. He is even telling people that South Korea will not enforce the U.N. trade embargo on North Korea.

Coup plotting generals are waiting for a wink of the eye or a slight nod of the head from Mr. Rumsfeld and the U.S. Defense Department.

The generals are ready to act immediately according to this source.

The Curse of Clinton?

Bill Clinton is out there joking that mangy old Republican dogs are telling folks that Democrats will raise taxes, send you to the poor house, and how terrorists loom on every street corner.

Bill Clinton is out there joking that mangy old Republican dogs are telling folks that Democrats will raise taxes, send you to the poor house, and how terrorists loom on every street corner. So, let me get this straight: Clinton is saying tax hikes are fine and dandy. He’s also saying that terrorism is not a threat.

This doesn’t strike me as a winning message.

Clinton may be more of a liability than an asset for the Dems. I hope he gets his message out. And I hope the GOP takes him on.

Tonight's Lineup

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.

CNBC's Kudlow & Company will broadcast live at 5:00pm EST this evening.We'll begin tonight with a look at the state of the stock market and economy. Our guests include:

** Brian Wesbury, Chief Economist at First Trust Advisors

** Diane Swonk, Chief Economist for Mesirow Financial

** Elizabeth MacDonald, Forbes magazine senior editor

YOUR MONEY, YOUR VOTE...Will there be a Bush policy reversal if the Democrats take Congress? On board to discuss are former labor secretary/UC Berkley professor Robert Reich and the Wall Street Journal's Steve Moore. (We'll also take a look at the budget and economic outlook with these two fine gents...)

Rob Portman, director of the Office of Management and Budget, will join us to offer his perspective.

A Nuclear Iraq & North Korea?...Sen. Sam Brownback (R-KS) and Sen. Ken Salazar (D-CO) will weigh in.

A political debate between Lanny Davis, author and White House special counsel in the Clinton administration; Terry Jeffrey, editor of Human Events; and Time magazine's Mike Allen.

It's going to be a great show - don't miss it...

Bill Clinton, Mark Steyn & Those Mangy GOP Dogs

(We had a dynamite poltical segment on last night's Kudlow & Company with Tony Blankley, Mark Steyn, and Tony Coelho. The following is a brilliant exchange from conservative genius/author Mark Steyn - who incidentally, has a new book out which is getting rave reviews. It's next on my reading list...)

KUDLOW: I want to ask you, Mark Steyn, right off the top, you heard Mr. Clinton. He says if you believe those mangy dogs, the Republicans, the 'Dems will tax you into the poor house and on the way there, there'll be a terrorist on every street corner.' Mark Steyn, what is your assessment of what Clinton is saying out there?

MARK STEYN: Well, he summed up the two basic core beliefs of the Democratic Party - that you need higher taxes, and that there is no terrorist threat. And both of those are profoundly wrong. The first makes us small like Europe which is basically voting for national suicide. And the second, one reason why there are terrorists on so many street corners in the world is because Clinton did nothing about it in the gay '90s. In fairness to him, that's a more credible Democrat message, a more credible message than saying, you know, 'Vote for the Democrats because there is gay Republican congressman predator on every corner,' which has been the Democrats' message for the last couple of weeks. That's ridiculous.

...In a way, there is either a threat or there isn't a threat. And Clinton's strategy of just joking and saying, `Oh, there's no threat. It's just some cockamamie thing got up by the Bush administration, actually works better than what those House and Senate Democrats did which is vote to make themselves look like the terrorists' rights party. I think it's clear that there's a lot of Republican anger among the base and conservative anger among the base about the conduct of this war, but every time the Democrats in the Senate and the House have to take a vote on issues like the detainees in Guantanamo, they put themselves in a very unattractive corner electorally. And I simply think that the American people are not ready to go there.

(Note: In the Senate, 75 percent of the Democrats voted against the terrorist interrogation bill. In the House, more than 80 percent voted against it. Sen. Harry Reid (D-NV) - who vehemently opposed the Patriot Act - actually said that he's "convinced that future generations will view passage of this bill as a grave error." Huh?)

KUDLOW: I want to ask you, Mark Steyn, right off the top, you heard Mr. Clinton. He says if you believe those mangy dogs, the Republicans, the 'Dems will tax you into the poor house and on the way there, there'll be a terrorist on every street corner.' Mark Steyn, what is your assessment of what Clinton is saying out there?

MARK STEYN: Well, he summed up the two basic core beliefs of the Democratic Party - that you need higher taxes, and that there is no terrorist threat. And both of those are profoundly wrong. The first makes us small like Europe which is basically voting for national suicide. And the second, one reason why there are terrorists on so many street corners in the world is because Clinton did nothing about it in the gay '90s. In fairness to him, that's a more credible Democrat message, a more credible message than saying, you know, 'Vote for the Democrats because there is gay Republican congressman predator on every corner,' which has been the Democrats' message for the last couple of weeks. That's ridiculous.

...In a way, there is either a threat or there isn't a threat. And Clinton's strategy of just joking and saying, `Oh, there's no threat. It's just some cockamamie thing got up by the Bush administration, actually works better than what those House and Senate Democrats did which is vote to make themselves look like the terrorists' rights party. I think it's clear that there's a lot of Republican anger among the base and conservative anger among the base about the conduct of this war, but every time the Democrats in the Senate and the House have to take a vote on issues like the detainees in Guantanamo, they put themselves in a very unattractive corner electorally. And I simply think that the American people are not ready to go there.

(Note: In the Senate, 75 percent of the Democrats voted against the terrorist interrogation bill. In the House, more than 80 percent voted against it. Sen. Harry Reid (D-NV) - who vehemently opposed the Patriot Act - actually said that he's "convinced that future generations will view passage of this bill as a grave error." Huh?)

From NRO:

In 2004, two out of three voters were investors, the majority of which voted to re-elect President George W. Bush. In fact, investors increased their vote for Bush from 51-46 in 2000 to 53-46 in 2004. As a result, Bush received 5 million more votes in the last election than the first time around, and eclipsed national levels for all categories of investors, including self-identified members of the investor class, 401(k) owners, and direct stockowners.

Today, however, even with the stock market at an all-time high, generic support for Republicans running for Congress has fallen. Why? Because the GOP has failed to explain how their pro-investor tax cuts produced the stock market boom. Additionally, Republicans have yet to put forth a compelling policy agenda that speaks to the desire of American shareholders to build savings and wealth for themselves and their families.

...Granted, the war in Iraq, the Mark Foley page scandal, and other issues are front and center these days. But the fact of the matter is that the GOP is not speaking to the aspirations of the middle-class investor voter....

In 2004, two out of three voters were investors, the majority of which voted to re-elect President George W. Bush. In fact, investors increased their vote for Bush from 51-46 in 2000 to 53-46 in 2004. As a result, Bush received 5 million more votes in the last election than the first time around, and eclipsed national levels for all categories of investors, including self-identified members of the investor class, 401(k) owners, and direct stockowners.

Today, however, even with the stock market at an all-time high, generic support for Republicans running for Congress has fallen. Why? Because the GOP has failed to explain how their pro-investor tax cuts produced the stock market boom. Additionally, Republicans have yet to put forth a compelling policy agenda that speaks to the desire of American shareholders to build savings and wealth for themselves and their families.